The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were reversed through 2016 and 2017 although sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

The strength of the US dollar exchange rate since mid 2014 had added an unusual weight to US dollar prices. Reversal of some of the currency gains has been adding to commodity price strength through 2017.

Signs of cyclical stabilisation in sector equity prices has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development has passed its most difficult phase with the appearance of a stronger risk appetite.

Resource Sector Weekly Returns

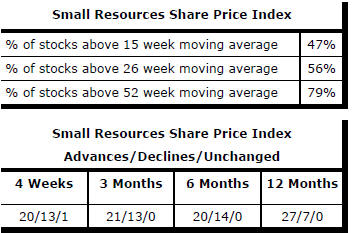

Market Breadth Statistics

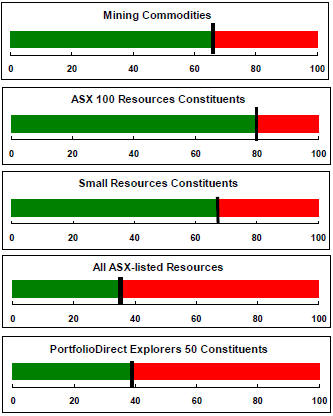

52 Week Price Ranges

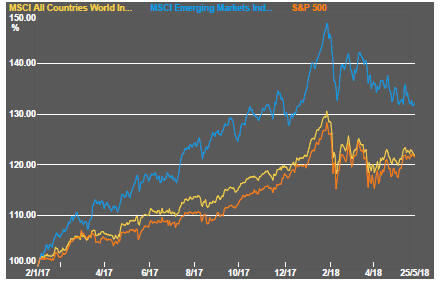

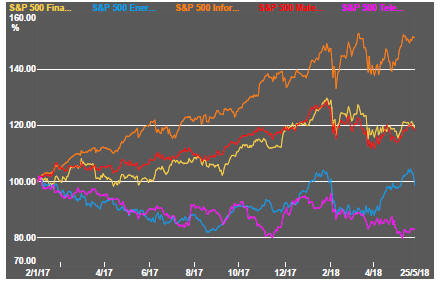

Equity Markets

Flagging momentum was again evident in equity markets as they reacted to a varied range of countervailing influences. Expected volatility continued to decline indicating relatively little anxiety about the issues impacting markets.

Among the main market sectors, technology again proved the most resilient. The energy component gave up much of its recent gains. Emerging markets remained under pressure.

US initiated trade uncertainties persisted with mixed messages over NAFTA and from those engaged in talks with China. Expectations of a quick settlement with China have swung wildly from an imminent agreement to an aggressive tit for tat trade war.

Optimism about prospects for an agreement with north Korea over deployment of its nuclear weapons were dashed when US President Trump cancelled from the planned summit in Singapore although, even there, the picture is unclear as both parties also said they wanted the talks to go ahead.

Federal Reserve policy committee minutes released during the week gave investors some comfort insofar as they showed policymakers willing to let inflation exceed 2% for a time and being still committed to gradual rises in interest rates.

Resource Sector Equities

Resources sector equity prices were generally weaker with the Australian market declining by more than global prices. Australian industrial share prices outperformed the resources component of the market.

Gold equities were generally higher although the north American junior market fell at the end of the week.

Interest Rates

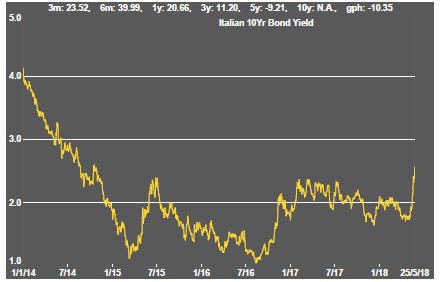

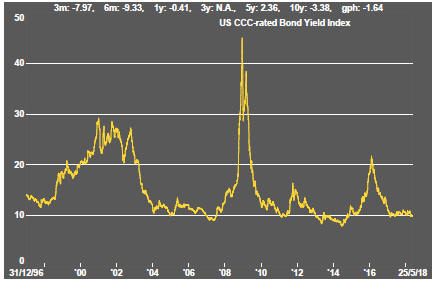

US 10 year bond yields retreated after having pushed through 3% the previous week but failing to break the long term downward trend.

US yields were impacted by some of the most significant financial market moves in several years as the political crisis in Italy grew in significance with the probability rising of a new election and, with it, a de facto vote on Italy's commitment to the euro.

Italian bond yields rose to their highest level in three years. German yields moved lower putting downward pressure on US yields as capital moved to safer ground. Yields on riskier corporate bonds were little changed.

Exchange Rates

The flight from developing economy currencies persisted. European political discord has also meant a dollar strengthening against advanced economy currencies.

While each of the developing market shifts could be attributed to the specific circumstances of the individual countries, recently higher oil prices have been a common factor among those which are oil importers such as Turkey and Argentina. Turkey raised interest rates by 300 basis points to avert further currency losses amid concerns about political interference in rate setting.

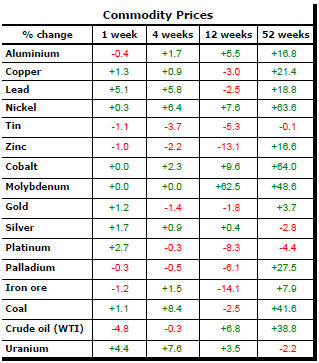

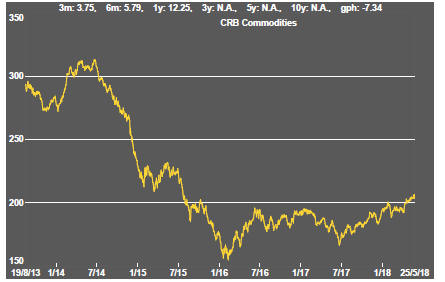

Commodity Prices

The general upswing in commodity prices over the past year had been given added impetus by stronger crude oil prices which eased back during the week, taking the CRB commodities index lower.

The CRB index has returned to levels last experienced in 2015. That still leaves prices within the bounds of a cyclical trough, albeit toward the upper end.

The flip side of the benefits for commodity producers and exporters of higher commodity prices is the cost pressures now being experienced by users of agricultural and raw material commodities. Reporting companies have been suggesting this as a source of margin compression.

Business surveys closely watched by the central banks are showing signs of upward pressure on selling prices as a result of higher raw material prices.

Gold & Precious Metals

Rising bond prices gave gold bullion process a fillip but they remain toward the lower end of the trading range of the past few months and appear to have been largely unaffected by the most recent geopolitical uncertainties to have roiled equity and financial markets.

Gold, silver and palladium all appear to be approaching points from which a change in direction could be expected. Trading patterns are suggesting large falls are possible although traders have withstood those pressures so far.

The divergence in trend between Australian and north American gold related equities remains evident with US markets more aligned with a sceptical view of the near term future of precious metal prices.

Nonferrous Metals

Prices of the main daily traded nonferrous metals have broken into three groups. Group one comprises those affected by threats to disrupt the metal trade arising from US sanctions on Russian economic and political interests, namely nickel and aluminum. The second group ivludes those metals being driven by broader macro trends which are experiencing a loss of momentum. The third category comprises tin alone.

The copper trading pattern shows a loss of momentum which could be restored but which is also consistent with a significant turning point. The rise in US bond yields which would normally signify more buoyant economic conditions, consistent with rising demand for copper, is not being reflected in the copper price suggesting that other influences are at work.

Bulk Commodities

Bulk commodity prices had given up some of their early 2018 gains but had shown some signs of modest recovery in recent weeks.

Relatively weak first quarter Chinese GDP growth suggests a ramp up in activity through the remainder of 2018 if China is going to meet its growth target which, in a centrally controlled economy in which leaders are trying to maintain credibility, is a reasonable assumption. Firmer bulk commodity prices are a possibility later in the year as China engineers a stronger growth outcome.

Oil and Gas

Crude oil prices had reached the highest levels in several years before breaking lower in the past week after hints from the major producers that production might be raised.

Russian president Vladimir Putin was reported as saying that a $60/bbl price would be adequate.

The sharp market response to the slightly more bearish tone might lead to some reconsideration of any plans to push output higher.

US production, in any event, continues to rise. US producers are able to profitably hedge anticipated production contributing to the ongoing rise in their output.

Keeping prices aloft have been fears of deteriorating political conditions in the middle east and Venezuela with the US president committing to stronger economic sanctions against both Iran and Venezuela.

Battery Metals

Eighteen months of rising lithium-related stock prices gave way to a period of market reassessment as a lengthy pipeline of potential new projects raised the prospect, although not conclusively, of ongoing supplies being adequate for expected needs.

Potential lithium producers have been able to respond far more quickly to market signals than has been the case in other segments of the mining industry with development prospects.

The fall in lithium related equity prices in the past week was within the bounds of overall sector equity prices.

Battery metals remain a focal point for investors with recent attention moving to cobalt and vanadium.

Doubts about a peaceful transfer of power in the Democratic Republic of the Congo (and an Ebola outbreak) has added a dimension to cobalt prices lacking in other metals caught up in the excitement over transport electrification.

In the longer term, cobalt is the most vulnerable of the battery related metals to substitution with high prices likely to stimulate research in that direction.

Uranium

The uranium sector is forming a cyclical trough as market balances slowly improve but in the absence of more meaningful signs that power utilities are prepared to re-enter the contract market to negotiate longer term needs.

Slightly higher equity prices from time to time, in the hope of improved conditions, have not been sustained but could be repeated as speculation about improved future demand ebbs and flows.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.