The Big Picture

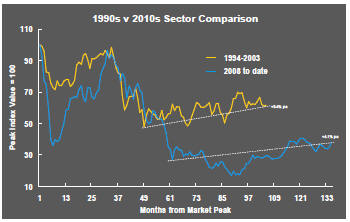

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

Equity prices turned lower as the ebbs and flows of the US-China trade dispute continued to disrupt daily market movements.

Mounting evidence of slowing global growth brought fears of subdued US manufacturing conditions finally filtering into employment growth, the one bright spot in the global economic picture. Favourable US economic outcomes have been sustained by a hitherto robust services contribution. Data during the week showed a fall in consumer confidence.

News leaked from the US administration that it was contemplating ways to block access to US capital markets by Chinese companies. Reports also referred to US government officials investigating how to prevent outward flows of capital in favour of China. Officials pushed back on these reports but admitted internal discussions had occurred. Whether or not these were tactical ploys ahead of further planned negotiations between US and Chinese officials, they were another source of market disruption.

Despite anxiety about growth and the disruptive effects of trade policy swings, US equity prices have remained close to record high levels. Valuations suggest an optimistic underpinning about how the various cross currents will play out.

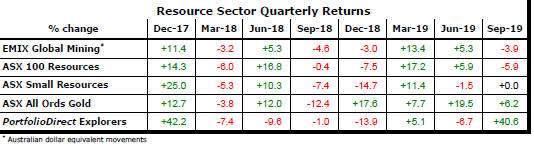

Resource sector equity prices reflected the broader market with modest losses once again defying expressions of pessimism about the global growth outlook. The price indicator used to track exploration investments rose dramatically after a high grade copper-gold intersection by Stavely Minerals, one of the constituents of the index, produced a recently rare discovery.

While metal prices are lower than their most recent cyclical high point in early 2018, the fall has been less severe than the average cyclical decline experienced by the sector.

The tension between metal prices and bond yields as indicators of economic growth remains, suggesting that, one way or another, some adjustment is still needed.

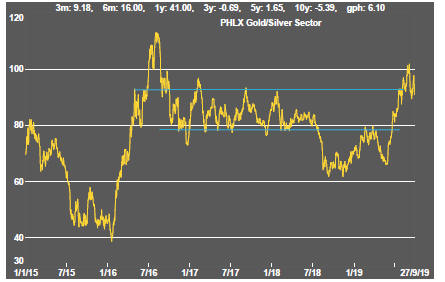

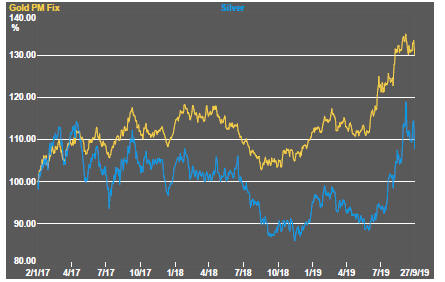

The gold bullion price rise has stalled as bond markets established new levels after the dramatic fall in yields through 2019. A firmer US dollar will have been another constraint on higher gold prices, as it has been on the full range of US dollar denominated commodity prices.

Evidence persists that the most recent rise in the gold price has been a product of changes in financial market relative prices rather than a longer duration structural shift in gold market conditions.

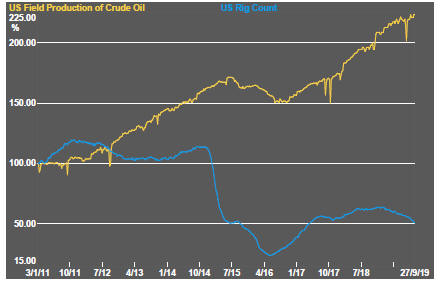

Oil prices lost ground. The easing in price after the market fright from the rocket and drone attack on Saudi production facilities suggested that, fear aside, the structural underpinnings of the oil market are not especially strong.

Cobalt prices edged higher but, within the battery metals space, pessimism still surrounds lithium investment prospects. Uranium investment conditions also remain cyclically week despite, as in the case of the lithium market, forecasts of outstanding growth in future usage.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium