The Current View

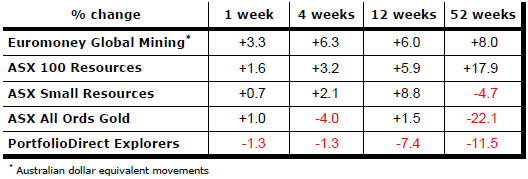

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Market Breadth Statistics

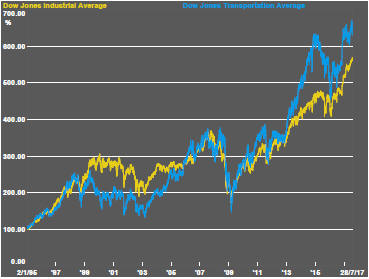

U.S. equity prices have struck new records although the lack of breadth among the stocks contributing to rising indices has remained a worry.

The Dow Jones transport index which has often been used as a market proxy for domestic economic activity and a leading indicator of the future direction of the broader market has shown signs of weakening in the past week to reinforce concerns that the market might have moved ahead too quickly and that economic conditions do not warrant the prices now being paid.

The fall in the U.S. dollar has been the most dramatic change in financial market conditions over the past few weeks.

The currency move is a boost to future earnings among the most internationally oriented of the listed U.S. companies. The flip side of this benefit is a negative impact on the earnings of European companies.

The U.S. dollar weakness will have contributed to improve U.S. dollar denominated commodity prices.

Among London Metal Exchange traded non-ferrous metals, prices of nickel and tin have moved higher as has the copper price which has converged on the aluminium and zinc prices which had headed the performance trends through 2017.

There is now a strong tendency for performance convergence across the non ferrous metal space.

The LME price movements during the year so far have highlighted the pointlessness of trying to pick commodity winners and losers with performance differences failing to last long enough to be a valid basis for an investment decision.

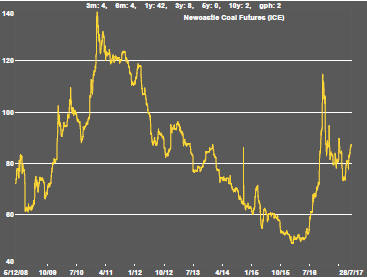

Coal prices have risen in line with the broader commodity complex improvement.

The U.S. dollar move has contributed to stronger gold bullion prices although the related equity prices have appeared to discount the importance or sustainability of the bullion price rise.

Coal prices have retreated from their most recent upward spurt but strengthened during the week as uncertainty persisted about the future of Chinese demand and the extent to which those needs will be sourced domestically.

In the context of exchange rate realignments, the Australian dollar has been rising against the US dollar which has had the effect of modifying demand for Australian dollar denominated equities and leaving the sector less responsive to rising commodity prices than might have otherwise been expected.

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.