The Current View

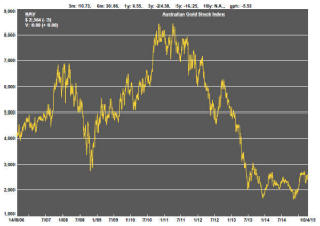

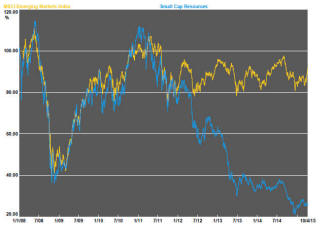

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments. The market is now entering a period prone to even greater disappointment about project delivery .

Has Anything Changed?

The assumption that June 2013 had been the cyclical trough for the market now appears premature.

Sector prices have adjusted to the next level of support. The parallel with the 1990s is being tested. Prices will have to stabilise around current levels for several months for the thesis to hold.

Key Outcomes in the Past Week

The week ended with rising global equity markets driven by favorable monetary conditions.

In the USA, news broke on Friday that underperforming conglomerate GE would dispose of its financial markets activities to concentrate on industrial manufacturing and services industrial products. The decision by the company to use US$50 billion to buy back shares raised the GE share price by 14.3% for the week and buoyed market sentiment there more broadly. Expectations of increased corporate activity leading to stronger market conditions were also given a fillip by the decision of Royal Dutch Shell to pay $70 billion for the BG group.

Markets in Shanghai (+4.4%) and Hong Kong (+9.0%) have been boosted by relaxation of quota restrictions on foreign and domestic investors. New linkages between the two markets have also permitted a stronger flow of funds to take advantage of relatively low Hong Kong valuations.

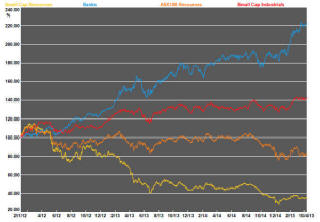

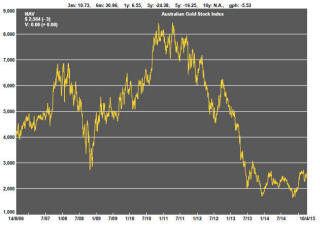

The apparently improved risk appetite among global equity investors has not led to a more favorable view about the resources industry. In the past week, the ASX small resources share price index rose 0.2%. The S&P/ASX 100 resources index rose 1.7%. At the same time, the MSCI emerging markets index moved higher by 4.0%.

Monetary policies in the USA, Europe, Japan and China have been a strong influence where markets have been relatively strong. Liquidity flows have facilitated the purchase of financial assets without resulting in an acceleration in global growth which dictates the cyclical positioning of raw material markets. Without evidence of changes in physical demand, prices of resource industry equities continue to lag other equity market segments.

Miners Confront Market Value Trap

There is a very common share price pattern among smaller resources companies

which reflects broader macro conditions but also the value dynamics within

the sector. Pilbara Minerals is one illustration of the difficultly

companies face in demonstrating a value proposition.

A market re-pricing such as Pilbara Minerals received

during September and October 2014 is followed by some initial retracement

and a period of relative share price stability.

Most typically, the earlier share price rise has been driven by a large increase in demand for shares because of a one-off discovery event. This may be accompanied by a more aggressive marketing of the company helped along by a supportive broker. In any event, the impact of these forces declines over time and volumes gradually subside.

At a certain level, new buying emerges but the trading range above this base narrows as new buying is progressively less effective in holding up the market value.

The eventual share price fall implied by the chart would force an increase in the number of shares required to fund the next stage of development putting further downward pressure on the share price and quickly eroding the value proposition. The company would find itself trapped by a cycle of falling prices and growing share issuance. Having already exhausted its currently known support base, by now containing many disappointed investors, the company is left with few options.

The only way to avert this fate, in the absence of a cyclical recovery that lifts all prices, is to recreate the circumstances that led to the earlier share price rise, including the cultivation of a new investor base.

Market Breadth Statistics