The Current View

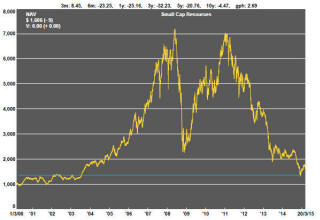

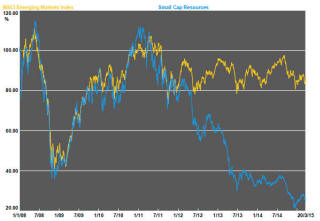

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments. The market is now entering a period prone to even greater disappointment about project delivery .

Has Anything Changed?

The assumption that June 2013 had been the cyclical trough for the market now appears premature.

Sector prices have adjusted to the next level of support. The parallel with the 1990s is being tested. Prices will have to stabilise around current levels for several months for the thesis to hold.

Key Outcomes in the Past Week

The headline said the US dollar had experienced its largest weekly fall since early 2011. While an accurate enough statement, the move did not detract materially from the strong upward trend evident in the currency for several months.

As observed in recent issues of PortfolioDirect, the currency market is showing the residual effects of central bank attempts to reset asset prices. Last week’s currency reversal for the US dollar - a fall of 2.4% against the basket of major trading partner currencies - came after Federal Reserve chair Janet Yellen seemed to foreshadow a slower move to raise interest rates than previously thought likely.

The possibility of interest rates being kept low for longer than had been expected gave US markets a further boost. The accompanying fall in the US dollar also gave stock prices whose foreign sourced earnings were losing value a fillip.

The biotechnology sector helped propel the NASDAQ market to a record close, matching the level at which it had peaked in 2000. The NASDAQ performance is more soundly based today than 15 years ago because companies are longer established and profitable.

The biotechnology end of the market is highlighting an appetite for risk which continues to bypass the resources sector although the former includes companies pursuing early stage development opportunities as well as established companies with strong cash flows.

A weaker US dollar helped gold and oil prices strengthen during the week. Friday’s rig count report from Baker Hughes showed a further 5% decline in the number of rigs over the week. The number of rigs was 59% lower than a year earlier although, on the latest numbers from the Energy Information Agency, production continues to rise.

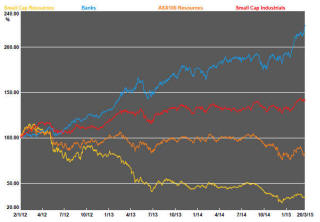

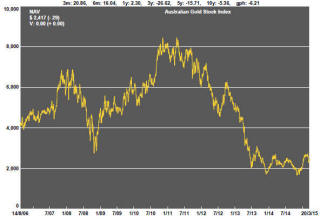

The interaction of European and US monetary policies is likely to be an ongoing influence on these and other commodity markets and, consequently, on the prices of companies with relevant exposure. Stock prices of the larger resources companies were relatively strong. The S&P/ASX 100 resources share price index rose 2.2% over the week. The small resources share price index fell 1.5%. The All Ordinaries gold share price index rose 4.3%.

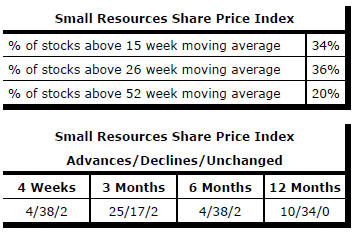

Market Breadth Statistics