The Current View

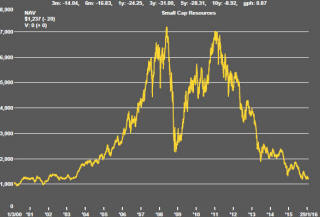

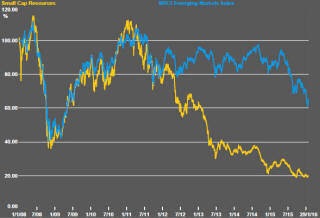

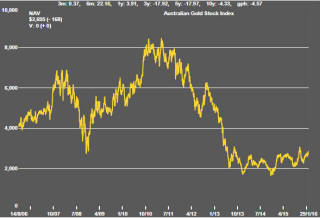

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments. The market is now entering a period prone to even greater disappointment about project delivery .

Has Anything Changed?

The assumption that June 2013 had been the cyclical trough for the market was premature.

Sector prices have adjusted to the next level of support. The parallel with the 1990s illustrated in Chart 4 is being tested. Prices will have to stabilise around current levels for several months for the thesis to hold.

Key Outcomes in the Past Week

Did Japanís central bank engineer a 0.1 percentage point cut in bond yields or did it reduce them by 50%? In other words, how significant for markets is a reduction in 10 year yields from 0.2% to 0.1% after decades of trying to reflate a moribund economy.

The surprise move into negative interest rates had an immediate positive impact on stock prices but also raised some uncomfortable observations about 2016 economic outcomes. It showed that drastic measures may still be needed to get economies to where they should be.

The new policy step has also raised the specter of competing exchange rate cuts to steal competitive advantages over trading partners. There is a scenario in which a more strongly growing Japanese economy spurs growth within the Korea-Taiwan-China-ASEAN region. That is the hoped-for outcome. On the other hand, signs of a snowballing lurch into a currency war joined by Europe will add instability to already fearful markets.

Weakening currencies could place added pressure on the U.S. Federal Reserve to retreat from its policy to raise interest rates gradually. A few more forecasters may also be prodded into thinking that the switch in policy to higher rates has been poorly timed leaving the Fed with little option but to rejoin its central bank peers in offering more monetary stimulus to help reflate economies (and, by default, equity markets).

As with previous monetary initiatives from the Fed, Europeís central bank, the Bank of Japan or the Chinese central bank, the latest move will have an initial impact on financial asset prices but do little to benefit the resources sector. Sector fortunes are closely tied to the real economy and less tightly connected to the monetary system.

The Japanese move seemed to reinforce the chance of a rising U.S. dollar and, consequently, more downward pressure on U.S. dollar denominated commodity prices.

Three other features of the market in the past week stood out for mentioning.

-

There was some slight improvement in the cyclical positioning of metal prices (as illustrated in the chart on page 1). The current position is consistent with a market seeking to define a cyclical trough although the exchange rate pressures described above could turn that possibility on its head as they did in 2014.

-

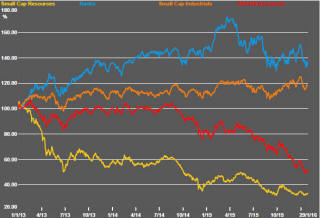

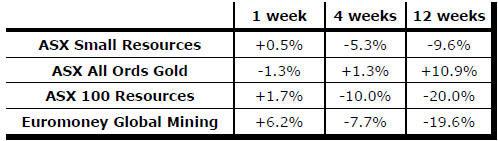

Resource sector prices (outside the largest stocks in the sector) have shown increased stability. The PortfolioDirect volatility measure (chart 3 opposite) has been tracking lower. This could have been consistent with much stronger prices, based on the historical experience, if the macro environment had been more supportive.

-

Equity markets appear to have been decoupled from China. This is both desirable and appropriate. Chinese equity markets are not necessarily sound guideposts for the state of the Chinese economy let alone ongoing relevant indicators for markets in Europe and the USA. .

Market Breadth Statistics