The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

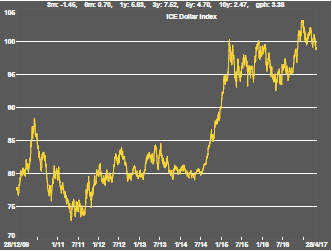

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Market Breadth Statistics

Oil prices, a long time driver of US equity prices, weakened during the week as concerns about oversupply resurfaced.

Despite the step lower in oil prices, equity prices remained near record levels, but without extending higher.

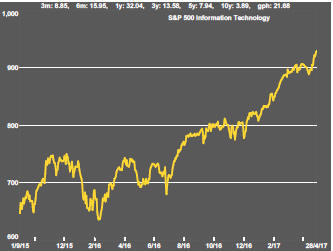

Driving the equity market gains was the technology sector with strong earnings outcomes and the potential to disrupt traditional industry structures among the themes contributing interest.

The financial sector which had driven US markets to their records has, more recently, been trailing the technology sector outcomes.

Banks are a part of the old industry landscape and potential targets of disrupters.

Bank stocks had also been re-priced in the expectation that deregulation would assist their earnings outcomes. While the new US administration has promised less regulation, this appears to be more targeted at smaller institutions than the larger banks with strong views throughout the political spectrum against reducing controls on larger institutions.

Also unclear is the extent to which interest rates will rise, allowing the banks to boost their trading margins, with bond yields tending lower most recently.

Wile the US dollar remains elevated by historical standards, some tendency to weakness has been evident in recent weeks.

The recent direction of the US dollar should have had a positive influence on US dollar denominated commodity prices but that potential benefit appears to have been quite muted suggesting that other macro pressures, such as expectations about growth, are affecting commodity price outcomes adversely.

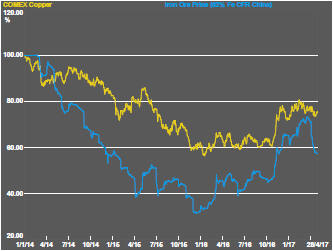

As the track of copper and iron ore prices shows, prices remain higher than they had been but the positive momentum from the latter part of 2016 has been lost.

To the extent that mining equity returns have relied on the directional shift (as distinct from the level of prices), that source has dissipated as a market benefit.

Consistent with the weaker currency, the gold price had been tending higher although here, too, the momentum was diminishing. The prices of related equities, shown here in the blue line, have been more volatile without producing any net gain over what would have been available directly from a bullion price exposure.

The loss of gold price momentum has adversely affected equity prices in the past week with the balance of risks tilted to the downside for equities in the sector.

With gold prices having pushed to the upper limit of the historical relationship with silver prices, the gold/silver price ratio has reversed direction.

While there is no reason why the historical relative price barrier should not be breached, the heavy influence of traders in these markets tends to keep the historical relationship intact and invites sellers or buyers to trade the relationship particularly at the extremes.

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.