The Current View

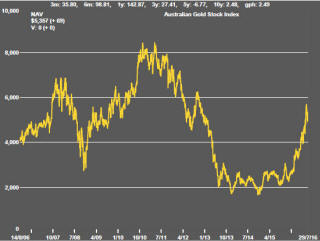

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

The S&P 500 share price index finished the week (and the month) within two points of its all-time record close a week earlier and after having set a new intraday trading high.

Oil prices moved in the opposite direction as concerns about a supply glut reemerged to push prices lower. After Iraq and Nigeria both upped their output, the Iranian oil minister described the market as oversupplied.

UK growth forecasts are being revised down as economists grapple with the impact of the vote to quit membership of the European Union. Survey data are pointing to a sharp decline in UK manufacturing output.

Commentators openly canvassing the need for an interest rate cut when the Bank of England next meets would have been stoking the negative business sentiment as well as, more broadly, expectations among consumers about the outlook.

US GDP growth of just 0.3% in the June quarter leading to an increase of 1.2% from a year earlier has contributed further to the sense of a modestly expanding global economy.

The US growth rate, subject to revision, was slightly higher than in each of the preceding two quarters but not so much higher as to detract from the view that the Federal Reserve will feel compelled to keep interest rates where they are for the time being.

Results of European bank stress tests, released after markets closed on Friday, were worrying but unsurprising. Several banks fell below critical capital adequacy benchmarks in the adverse scenario against which they were tested. Many, including some of the largest, were sitting around minimum acceptable capital levels.

The

stress test analysis suggests that the banking sector as a whole will be

more inclined to shore up balance sheets in the year ahead rather than look

to boost lending significantly.

The

stress test analysis suggests that the banking sector as a whole will be

more inclined to shore up balance sheets in the year ahead rather than look

to boost lending significantly.

Bond yields continued to push against record low levels in the USA and Europe. US 10 year government bond yields closed at 1.45%. Spanish yields dropped to 1.0%. German yields remained negative. Italian yields sat at 1.2%.

This global yield backdrop offers scope for further reduction in US yields (as well as those in Australia) despite how far they have fallen already but also poses difficulties for the attempts by banks to rebuild profitability and financial strength.

The US dollar returned to levels last experienced in late June as the yen rose and markets responded to the weaker than expected second quarter GDP report from the USA. Disappointment among investors who had been hoping for more aggressive market intervention by the Bank of Japan also contributed.

The S&P 500 volatility index fell through the week signalling perceptions of a relatively benign environment. The next significant move would normally be a reversal to higher levels but there is nothing in the historical performance to indicate when this might happen.

Gold prices rose $29/oz in response to signs central banks are unlikely to change their policy stance on interest rates within the foreseeable future with a return to higher rates in the USA, where an increase is seemed most likely, being relegated to a back burner.

Overall market action reinforced perceptions of weaker growth and continued strong central bank liquidity infusions underpinning equity market performance.

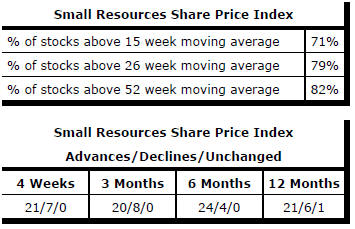

Market Breadth Statistics