The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were reversed through 2016 and 2017 although sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

The strength of the US dollar exchange rate since mid 2014 had added an unusual weight to US dollar prices. Reversal of some of the currency gains has been adding to commodity price strength through 2017.

Signs of cyclical stabilisation in sector equity prices has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development has passed its most difficult phase with the appearance of a stronger risk appetite.

Resource Sector Weekly Returns

Market Breadth Statistics

52 Week Price Ranges

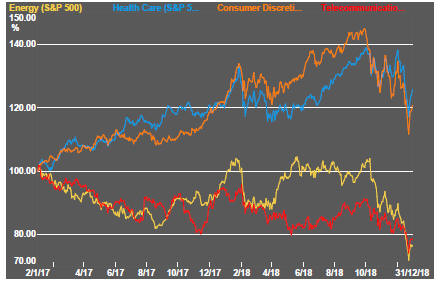

Equity Markets

The last days of 2018 were typified by whipsawing equity prices with new records for points moved within a day.

The range of influential factors has not changed greatly for several months with the Sino-US trade policy dispute, uncertainty over US Federal Reserve policy and slowing economic growth rates leading the way. Other issues, such as the ongoing Brexit saga and developing country policy failings have been pushed down the list.

Machines driving algorithms tied to technical settings have added to volatility, according to some, although they have been operating throughout 2018 without similar effects. Others have suggested unusually large numbers of hedge fund liquidations have caused price swings as large orders have been executed. While plausible, and suggested of less volatile conditions in the new year, this effect remains unproven.

Within the US market, where these forces are predominantly playing out, smaller stocks have underperformed the remainder of the market suggesting a broad-based set of macro concerns despite persistent claims by policymakers that the US economy is in great shape.

US equity prices movements are consistent with a rising probability of a US recession during 2019. Evidence of this not happening will be helpful in stabilising markets but, for that to happen, the US and China will need to resolve their trade dispute.

Threats to global supply chains are adding uncertainty about earnings. As well as the possibility of trade between China and the USA being disrupted, supply chain disruption is also a risk in post Brexit Europe and within North America with the replacement for the NAFTA not having been ratified by the US Congress where Democrats will assume control of the House of Representatives in early January.

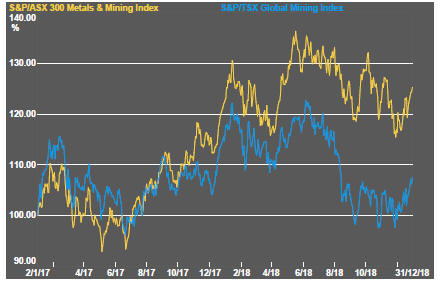

Resource Sector Equities

Resource sector equity prices finished the year on a rising trend despite the mayhem in other market segments.

A relatively weak performance over the past several years among mining stocks has limited the downside risks in equity prices which have centred on many of those companies and sectors which have performed most strongly.

The largest companies in the mining sector will also have benefited from some portfolio diversifying tendencies as funds flow from sectors facing the strongest headwinds into those which have underperformed or to which low weights have been given. Favourable gold price movements have also been helpful.

Nonetheless, the relative strength of the mining sector is surprising against the backdrop of mounting evidence of a slowdown in Chinese economic activity. The resilience displayed by the headline mining indices has not been replicated within the smaller end of the market where returns from exploration stocks have generally continued to flounder.

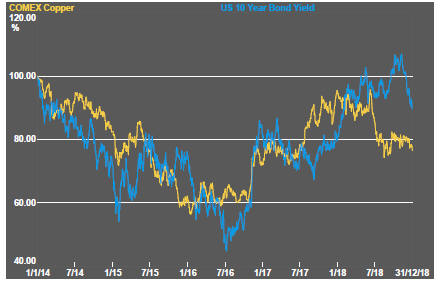

Interest Rates

Government bond yields have been falling once again, consistent with growing concerns about a slowdown in growth rates in every major geographic region in the coming year. The fall in yields comes despite central banks in Europe and the USA offering less support for bond prices with the withdrawal of quantitative easing and retention by the US Fed of its view that further rate rises during 2019 will be consistent with the state of the US economy.

Having made the case for a continuation of above trend growth in the USA, the Fed has painted itself into a difficult corner insofar as it now has a more optimistic view of economic outcomes than financial markets are beginning to adopt which will be highly disruptive in the event that it must reconsider and take corrective action.

For the mining industry, the most important change in financial market conditions has been the ongoing rise in yields on low rated corporate bonds, against the trend in low risk government securities. As long as this trend persists, funding conditions for mine developers will be deteriorating.

Exchange Rates

Currency movements have stabilised amidst the greater volatility elsewhere, with a marginally weaker US dollar. Perhaps the most significant currency move near the end of the year has been the drop in the Australian dollar which has helped underpin stronger returns for the gold sector. That said, overseas investors will remain wary about buying into stronger Australian dollar earnings if ongoing falls in the currency are likely to erode prospective investment gains.

Commodity Prices

The general upswing in commodity prices since mid 2017 had been given added impetus by stronger crude oil prices which have, more recently, underpinned a reversal in the trend.

The cost pressures which had been reported by many companies as a result of higher commodity prices should be easing and removing a source of upward pressure on selling prices which would, in turn, reduce the potential impact on inflation and on interest rates.

One of the causes of disquiet about the intentions of the Federal Reserve arises from its pursuit of higher interest rates even as inflation continues to undershoot official targets. Central banks tend to discount the influence of oil prices on measured inflation in deciding on policy settings but the most recent trend in commodity prices, driven by the drop in oil prices, suggest reduced overall inflation pressures and a lessened need for further policy adjustments.

Gold & Precious Metals

Gold prices have responded to the change in financial market conditions and, in particular, the renewed upward trajectory in bond prices. Silver prices, which had initially responded more sluggishly, made stronger games as the year drew to a close. The strength in the palladium prices has appeared to moderate having reached the upper end of a three-year rising trend. Platinum prices have remained unusually sluggish without sign of recovery.

US equity market conditions will have limited the responsiveness of gold-related equity prices to stronger bullion market conditions.

Nonferrous Metals

Twenty eighteen has finished with tin prices outperforming the other five daily traded non-ferrous prices with zinc doing the worst, reversing widespread expectations at the start of the year. In any event, all six metals have produced a negative return for 2018 as a whole.

The apparently divergent messages from the copper and bond markets about global growth conditions are being resolved in favour of the judgements displayed within the copper market. That said, the copper price has held up even as the fears about growth have appeared to intensify in markets outside the metals complex.

Bulk Commodities

Iron ore and coal price movements have been consistent with the broader metals picture. Despite the widening gloom about global economic activity, they have steadied although a period of earlier weakness may have foreshadowed what was to follow later among the previously overly optimistic equity investors.

Reported Chinese GDP growth in the September quarter was consistent with official forecasts, as one would expect in a centrally controlled economy, although hitting the targets is becoming more challenging by the year. The tariff fight with the USA is taking a toll on activity rates in an economy with a bias toward less strong growth in the years ahead, in any event.

The latest manufacturers purchasing managers surveys for China, measuring conditions in October and November, implied continuing slowing in momentum with signs of contraction in the latest data.

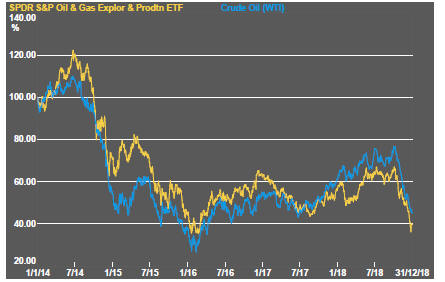

Oil and Gas

Crude oil prices have continued to fall sharply as excess supply and slowing demand are both now influencing market conditions.

OPEC appears to have lost much of the influence over the market it had previously enjoyed, perhaps permanently, but Saudi Arabia and Russia have joined in an effort to exert some additional influence and mitigate the effect of rising US production.

In trying to manage the crude oil market, the two largest producers could be creating more volatility as speculators trade around not only macroeconomic conditions which would normally affect prices but also anticipate judgements about how the two countries will react to changing market outcomes.

The prices of oil and gas exploration and production companies have fallen to levels which prevailed in early 2016 during the previous bout of oil price weakness.

Battery Metals

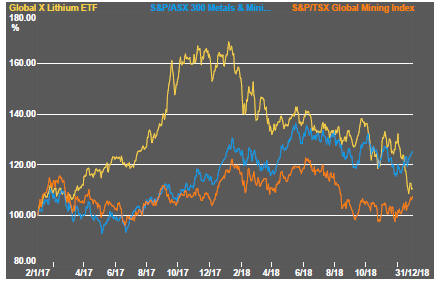

Eighteen months of rising lithium-related stock prices have given way to a prolonged period of market reassessment as a lengthy pipeline of potential new projects has raised the prospect of ongoing supplies better matching expected needs.

Despite the dynamism of the lithium industry and near certainty of its outstanding growth prospects, the equity market response has been more negative than for other parts of the mining industry throughout 2018.

Potential lithium producers have been able to respond far more quickly to market signals than has been the case in other segments of the mining industry where development prospects have been slowed by reticence among financiers to back development.

Movements in lithium related equity prices had been aligned more closely with overall sector equity prices through most of 2018. Deteriorating funding conditions for early stage mining companies will be aggravating tendencies to weakness among the budding lithium mine developers where the vast number fall into this category.

Battery metals remain a focal point for investors with recent attention moving to cobalt and vanadium.

Doubts about political conditions in the Democratic Republic of the Congo (and instances of Ebola) have added a dimension to cobalt prices lacking in other metals caught up in the excitement over the longer term impact of transport electrification. Short term market tightness relating to non-battery demand is easing.

In the longer term, cobalt is the most vulnerable of the battery related metals to substitution with high prices likely to stimulate research in that direction.

A spokesperson for Panasonic, manufacturer of batteries for Tesla motor vehicles, has been quoted as saying that the company intends to halve the cobalt content of its batteries because of uncertainties over supply although, offsetting such a move, will be the rapid increase in the number of units produced.

Uranium

The uranium sector is in the midst of forming a prolonged cyclical trough as market balances slowly improve. Power utilities have been reluctant to re-enter the market for contracted amounts of metal to meet longer term needs although an upward bias in prices is now evident.

The effect of an announcement by Canadian producer Cameco to extend the duration of its previously implemented production cut gave the market a very slight but quickly lost lift.

Slightly higher equity prices from time to time, in the hope of improved conditions, have not been sustained but could be repeated as speculation about improved future demand ebbs and flows.

News that the Kazakhstan government intends to list its state owned uranium producer, also the world's largest producer, may suggest greater responsiveness to market conditions and less emphasis on production to maximise government revenue.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.