The Current View

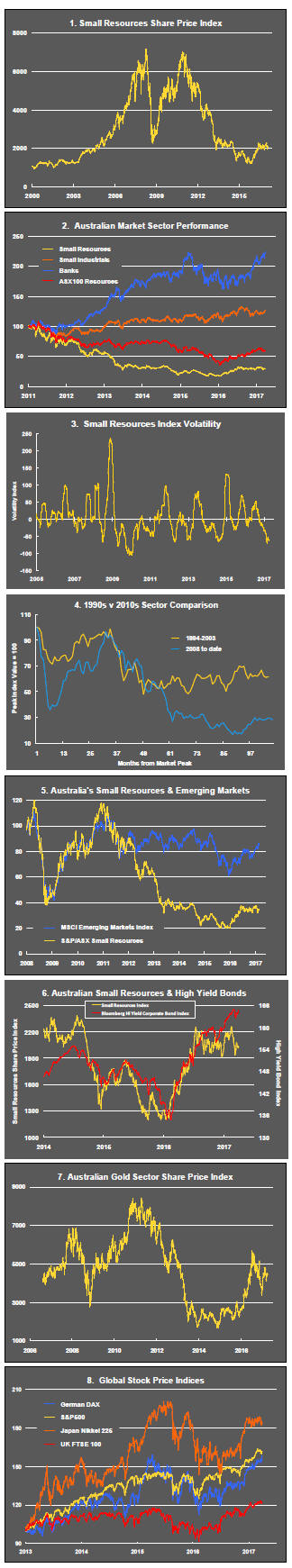

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Market Breadth Statistics

Crude oil prices began rising during the week and, in doing so, added some impetus to equity markets.

Stronger oil prices came too late in the month to avert a negative outcome in the S&P 500 energy index for March.

Only three of 11 S&P 500 segments - consumer discretionary, information technology and materials - showed positive returns in March.

There was a 5.3 percentage point difference between the strongest performing segment (information technology) and the weakest (energy) extending the performance gap since the start of 2017 between the two most divergently performing sectors to 19.5 percentage points.

The financial services segment of the market which had led performance in the past year has been an important contributor to the loss of market momentum.

The financial sector has been a potential beneficiary of higher bond yields, lower corporate taxes and promises of less heavy handed regulation. However, sources of improved performance are sufficiently well known to have already led to a significant re-pricing of the sector, at least for the present.

Higher equity returns have not been solely about U.S. economic conditions and the impact of policy changes under the Trump administration.

The German equity market is reflecting a belief in improved German as ell as broader global economic conditions.

The optimistic international perspective is consistent with the performance among S&P 500 information technology stocks which tend to have a more global orientation than other parts of the umbrella index.

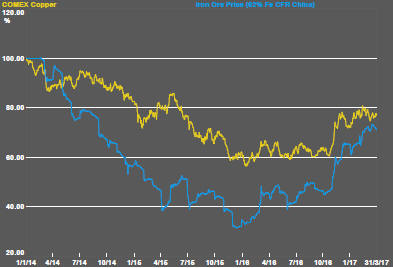

Consistent with the loss of momentum evident in markets and in the macro data, copper and iron ore prices have remained at elevated levels without making significant further gains.

The small resources segment of the market continues to display low volatility contributing to a prolonged period of largely unchanged prices.

The key equity indicators for the industry moved within a range of small gains and small losses in the past week even against the backdrop of improvements in financial market conditions (as illustrated in the sixth chart in the right hand panel) from which the sector should have benefitted.

The disparity between equity market outcomes and financial market conditions suggests ongoing reticence by investors to acknowledge a sufficient improvement in global economic conditions to push prices higher. Also possibly in play are often expressed concerns about the quality of investment opportunities.

The disparity also suggests some pent up demand to underpin future price action but this looks increasingly likely to be released only with a favourable macro catalyst given the market resistance in otherwise supportive equity market surrounds.

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.