The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

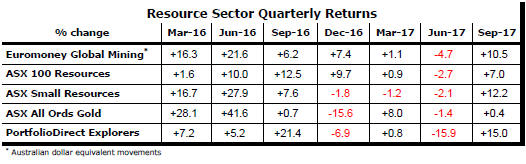

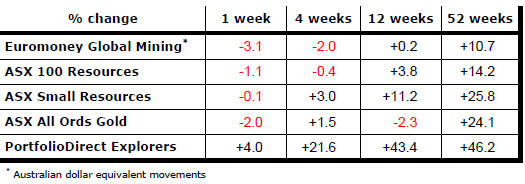

Resource Sector Weekly Returns

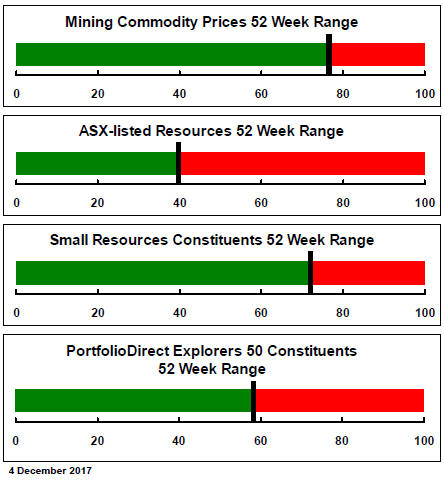

Market Breadth Statistics

More US market records have been attributable to expectations in the USA that tax reform proposals before the Congress will be passed before Christmas.

Strong markets have not been confined to the US with emerging market equity prices following a similar track to those for US companies.

While US tax policies will have a beneficial effect on earnings over the coming two years, helping to realign valuations, accommodative monetary policies which have been feeding asset prices are the common factor across all markets.

Within the US, technology stocks which had been the leading sector continued to show signs of lost momentum.

Telecommunication stocks produced strong gains in the past two weeks after concerns about competition in the sector have been having a detrimental impact on valuations.

US government bond yields have remained in a narrow range and somewhat at odds with expectations of higher growth and forecasts of higher inflation.

As short rates have risen, yield spreads have narrowed. The resulting yield curve has been taken by some as a harbinger of eventual recession if rate rises are not stalled by policymakers or even reversed.

Comments by Fed policymakers have shown signs of anxiety about the absence of an inflation acceleration. A rate rise before the end of 2017 is still expected but doubts are rising about whether the previously expected 2018 normalisation trajectory will be realised.

The rise in the US dollar which had accompanied expectations about tax cuts has lost momentum. Stronger sterling and euro exchange rates based on changed expectations about Brexit and European growth prospects were having some impact.

The modestly weaker exchange rate should have had a beneficial effect on commodity prices but gold prices moved lower as did the prices of gold related equities.

Despite the decline in equity prices, a wide gap in returns between US gold related equities and the Australia market segment remains a feature of sector performance.

US stocks are trading near the lower end of their trading range while Australian stocks are near the upper end of the 2017 range suggesting the balance of risks now favours the US companies.

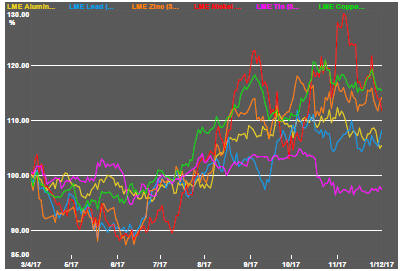

The momentum of daily traded metal prices has eased although mining commodities are generally within 20% of the top of their 2017 trading ranges. Tin prices have remained a relatively less volatile laggard within the sector throughout 2017.

Crude oil prices have been gradually firming and now sit at levels higher than at any time over the past two years.

While the prices of exploration and production companies have responded to the more positive trajectory of crude prices, the leverage to the improved conditions has been limited.

The price action suggests that equity investors remain sceptical about OPEC being able to hold the line on production (or that US producers will upset their plans by responding to higher prices by upping their output).

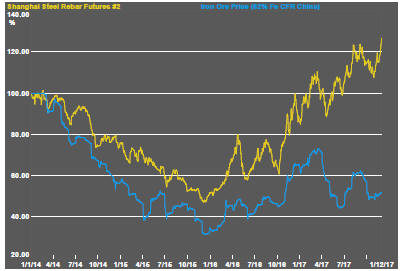

Higher Chinese steel pries have helped impart modestly stronger iron ore prices but, overall, iron ore prices have shown diminishing responsiveness to higher steel prices (and improved steel industry profitability).

Uranium related equity prices have shown strong gains in response to announcements about production cuts in Canada and, more recently, in Kazakhstan by the world's largest producer.

Having been in such a prolonged cyclical decline, the large bottom of the cycle returns have left absolute price levels still close to their cyclical troughs.

Power utilities appear confident, at least for the time being about being able to source their needs. Meanwhile, existing producers have an incentive to meet contractual obligations through purchases on the spot market.

These tendencies imply that adjustment is underway and that, at some point in the future, new production will be needed.

Investors with a longer term view should be looking at this market segment as the one remaining part of the resource complaex to offer prospects of a cyclical recovery.

The Australian dollar continues to show a bias to the downside. With commodity prices losing their upside momentum and fewer forecasters expecting to see higher Australian interest rates, a tax reform breakthrough in the US places additional downside pressure on the Australian currency.

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.