The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

US equity markets were pulled lower by oil prices during the week but managed to mount a modest recovery after relatively weak August employment gains were reported.

Renewed weakness in the energy sector came after more evidence of an ongoing market surplus. By the end of the week, however, some hope had emerged of renewed production constraints.

A meeting of OPEC and non-OPEC oil producers is scheduled in Algiers for late September to address the possibility of reaching an agreement on production rates. Equity markets responded positively to reports that Russia might support production cuts but the tug of war between Saudi Arabia and Iran for market share remains the most serious impediment to concerted action.

Meanwhile, US equity markets continued to respond to the succession of Federal Reserve governors opining about the direction of interest rates.

The Federal Reserve system is designed to produce a diversity of views. The freedom to speak publicly is supposed to help understanding the policy setting process but, equally, the plethora of opinions risks creating unintelligible noise.

The Federal Reserve interest rate setting process

is at risk of losing credibility by having so many able to speak on behalf

of the policy setting process without any being able or willing to say

something definitive.

Markets appear to be pricing in one rate increase during 2016. That will most likely not reduce market uncertainty about the direction or level of future interest rates as attention will then refocus on when the next increase is likely to occur. That will be the case as long as the Fed seems to exercise so much discretion over the timing of rate changes and appears so willing to respond to such a wide range of market influences in coming to judgements about when rates should change.

The strange relationship between the Fed and markets was highlighted by the disappointing 151,000 increase in employment reported on Friday and the weak 0.2% increase in wages in August. Despite the negative implications for growth, equity markets strengthened because of the inferred delay in the next interest rate rise drawn from the statistics.

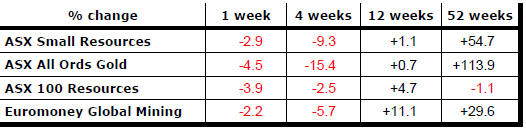

Despite equity markets generally pushing higher, resource sector prices have shown further evidence of a momentum loss. Prices of the sector’s largest stocks are now no higher than they were a year earlier. The smaller companies which had the greatest leverage to improved investor risk tolerance during the first half of 2016 have produced the best gains but are also losing ground.

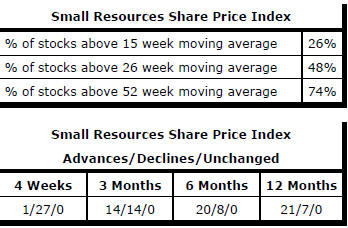

Market Breadth Statistics