The Current View

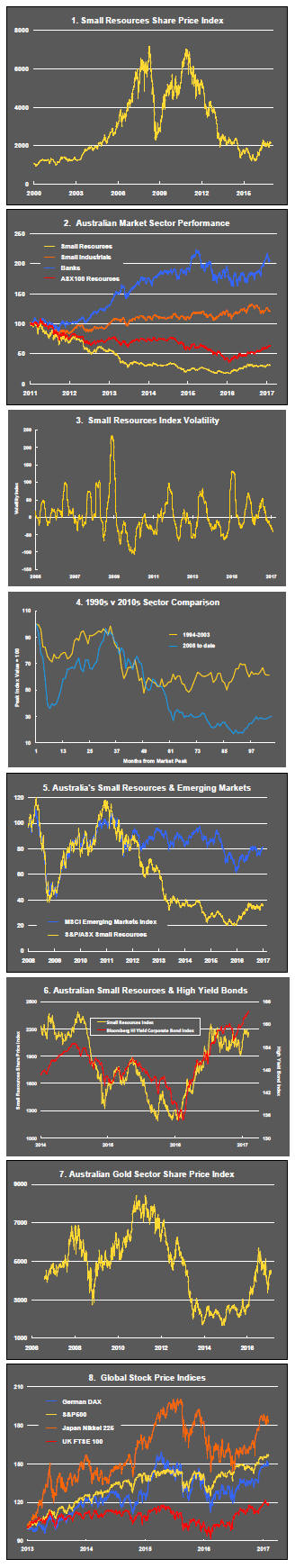

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

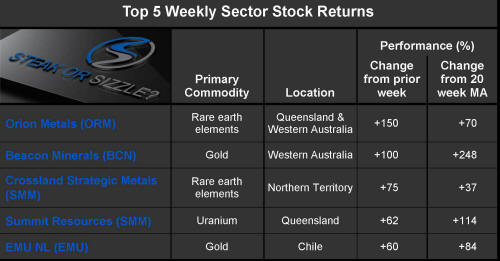

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Market Breadth Statistics

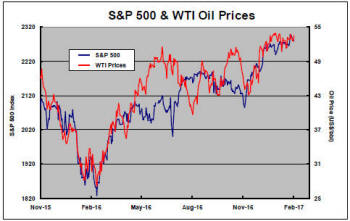

Markets remained near record levels within the context of a continuing loss of momentum.

Market direction has continued to match the movement in oil prices which have risen in the expectation of a production cut among the world's major non-US producers. An upturn in US production in reaction to higher prices is shaping up as an offset to the OPEC initiated cuts.

The US dollar continued to weaken against the currencies of its major trading partners as uncertainty about the trade policies of the newly installed Trump administration destabilised the currency market.

Exchange rate movements had a beneficial effect on commodity prices.

The exchange rate effect appears to have outweighed the otherwise potentially negative influence of US government bond prices which tracked lower during the week.

While short term deviations between bond prices and gold bullion prices are not unusual, the longer term pressures remain unfavorable for gold bullion prices with a bias toward a stronger exchange rate and weaker bond prices and an already strong reaction among Australian gold miners to relatively modest bullion price gains.

The small resources share price index shown in the first chart in the right hand panel remains stuck around its early 2015 levels despite a more favourable risk environment and the continuing uptrend in the prices of the larger stocks in the sector.

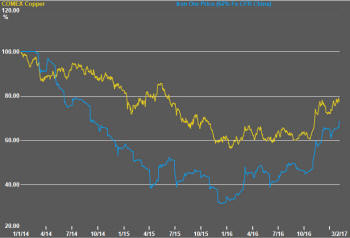

The reluctance of investors to push prices higher in the mid-cap space comes despite a clear improvement in the appetite of investors for higher risk opportunities.

The Merrill Lynch index of yields for lower rated corporate bonds continued to decline indicative of further improvements in financing conditions which have not been reflected in equity prices.

The absence of any significant movement in the PortfolioDirect index of 50 ASX-listed explorers reinforces the conclusion that the market has not yet embraced the sector sufficiently strongly for generalised price rises across the three key segments of the market.

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.