The Current View

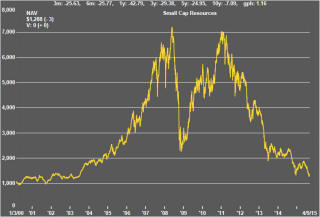

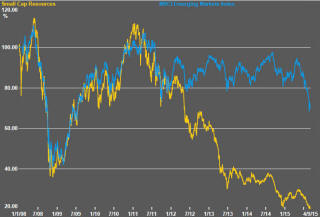

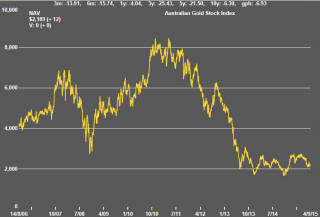

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments. The market is now entering a period prone to even greater disappointment about project delivery .

Has Anything Changed?

The assumption that June 2013 had been the cyclical trough for the market was premature.

Sector prices have adjusted to the next level of support. The parallel with the 1990s illustrated in Chart 4 is being tested. Prices will have to stabilise around current levels for several months for the thesis to hold.

Key Outcomes in the Past Week

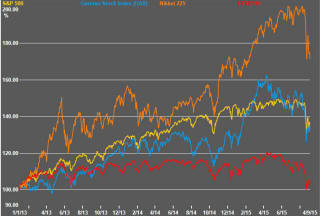

Markets remained susceptible in the past week to the same cocktail of uncertainty as in recent prior weeks. China, Federal Reserve policy, oil prices, bond prices and exchange rates remained influential although their impacts varied from day to day as different interpretations of what was happening prevailed for the moment.

Global market volatility has tempered expectations that the Federal Reserve will hike the Fed Funds rate at its meeting later in September. At the same time, the employment data from August released on Friday again showed an improving U.S. labour market. The unemployment rate has now fallen to within the Fedís prior benchmark for full employment and to the point at which it had said it would consider pushing interest rates higher.

The Fed may once again seek to redefine the unemployment rate that might trigger reconsideration of a rate rise, as it has done before, but that could also prove counterproductive insofar as it creates more uncertainty about the trajectory and timing of policy and more prolonged market volatility.

The Fed is set to produce market volatility whatever it does. Taking no action at the next meeting simply leaves markets speculating about when the inevitable will occur and what conditions will be necessary. The first upward move in interest rates in nine years will leave open questions about what comes next and, without inflation pressures and higher bond yields, why rates need to rise.

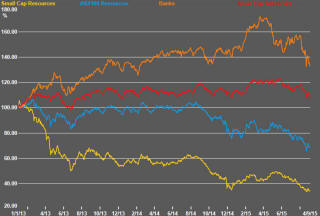

The current preoccupation with deteriorating global growth is weighing on markets globally including resource sector prices although the resource sector adjustment began somewhat earlier and has been less precipitous than the price slump experienced in other sectors and geographic areas.

With rising volatility, the small resources share price index fell 5.7% during the week. The resources stocks in the S&P/ASX 100 fell 4.1%. Energy stocks were pushed 7.3% lower during the week despite firmer crude oil prices through the week than had prevailed in the week before.

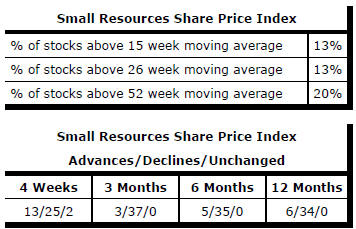

Market Breadth Statistics