The Current View

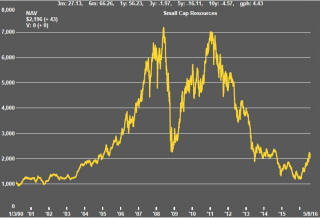

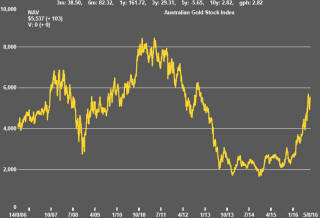

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

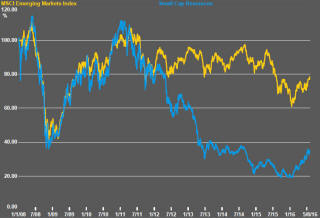

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

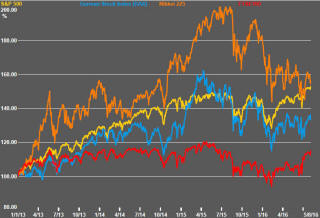

The week ended on a strong note for the US equity market after a second successive month of above average employment gains although oil prices had been a dampener on markets.

Along with the 255,000 increase in July nonfarm payrolls, the government reported a 2.6% increase in wages over the prior 12 months.

Once again, the subsequent commentary revolved around what the latest labour market statistics would mean for interest rates but the day’s price action suggested that the beneficial effect on corporate earnings of higher personal incomes was more important than the increased chance of a near term rate hike.

In any event, analysts seemed willing to conclude that the chance of a rate increase had not changed materially.

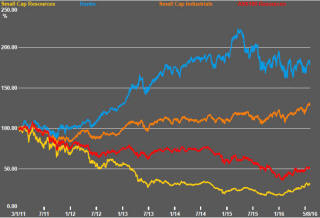

In the Australian market, the small industrials share price index has been on an upward trajectory, returning it to early 2008 levels. Since the beginning of 2009, the small industrials accumulation index has increased at an annualised rate of 4.2% (compared with an annualised 12.5% contraction in the small resources index).

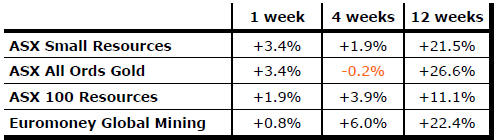

In

the near term, the small resources sector has been trying to close the

performance gap with the industrials. After having underperformed the

industrial mid-size group of companies for the best part of five years, the

resources component has extended its 12 month performance lead over the

industrials by nearly 40 percentage points.

In

the near term, the small resources sector has been trying to close the

performance gap with the industrials. After having underperformed the

industrial mid-size group of companies for the best part of five years, the

resources component has extended its 12 month performance lead over the

industrials by nearly 40 percentage points.

It remains too early to judge whether the resources performance has improved sufficiently to attract more investor interest to the sector. More time may be required to wash away memories of large losses over many years.

The possibility of sustaining the recent momentum may yet prove little more than wishful thinking if the apparent resurgence in sector equity prices is simply due to a rebalancing of macro monetary influences rather than more fundamental changes with an impact on value.

A judgment on this point is relevant to the outlook for companies in the Australian market as well as for international mining equities.

The Euromoney global mining index, for example, has risen by more than 50% since the beginning of 2016 to claw its way back to prices which had prevailed in early 2015 but has yet to show enough force to push beyond those levels.

Those earlier prices may act as a barrier to further gains without the improved global growth momentum which would bring stronger raw material demand and the tighter market balances that normally sustain higher prices.

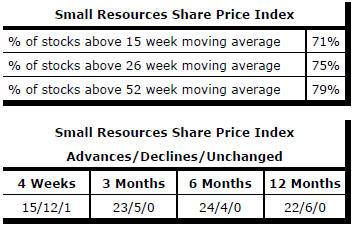

Market Breadth Statistics