The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

The gap in performance between oil prices and U.S. equity prices was again evident after several months of a tight correlation.

There are reasons are for the two prices going into a separate ways. The oil price is no longer seen as an indicator of global growth. Investors have increasingly begun to think of it as reflecting specific oil market balances.

The S&P 500 has become more closely linked to anticipated movements in U.S. interest rates and stalled earnings as companies try grappling with a recession in sales.

Equity

market prices have struggled to keep rising. The large rises which have

occurred in recent months have typically followed equivalently sized falls

in prices which have attracted fresh buying.

Equity

market prices have struggled to keep rising. The large rises which have

occurred in recent months have typically followed equivalently sized falls

in prices which have attracted fresh buying.

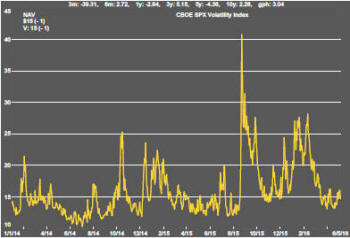

S&P 500 volatility has remained a low. While this is conducive to an appreciating market, it also suggests risks to the downside as events, such as political developments in Europe and the USA, could more easily push volatility higher.

The 160,000 gain in employment in April announced on Friday was below median expectations but not much different from a long term rate of increase consistent with population growth. Relatively high additions to the numbers employed will have to recede to a more sustainable level eventually.

Interest rate expectations have continued to move toward fewer rises in 2016. A single rate rise in the balance of the year is becoming an increasingly widespread expectation as economic conditions appear to be overwhelming the desire of the Federal reserve governors to get rates on a more normal trajectory.

Resources sector prices lost ground. Generally, larger stocks suffered worse falls while gold stocks again moved higher. Phase I stocks continue to show strong bottom of the cycle leverage although they also find difficulty in holding gains that are made.

After nearly three years, the gold price is showing the first signs of breaking through a declining trend. With a falling US dollar exchange rate accompanying a reappraisal of future interest rate movements, a higher gold price is hardly surprising. Perhaps the modest nature of the price rise in response to what are significant changes in the direction of other financial markets is the most surprising aspect of the gold market.

Politics - Decisions to be Made in 2016

Financial market interest is gradually moving toward political outcomes.

Upcoming votes on whether the UK should remain a member of the European

Union and the choice of a U.S. president later in the year are prone to have

an unusually strong impact on securities markets with each decision having

potentially serious and long-term impacts on the conduct of policy.

With decisive votes still possibly swinging, the possibility of market disruption and consequential adverse growth impacts are likely to rise during the balance of 2016.

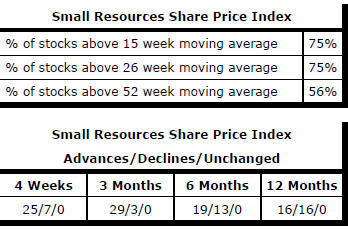

Market Breadth Statistics