The Current View

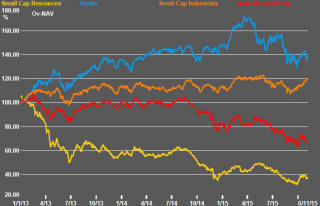

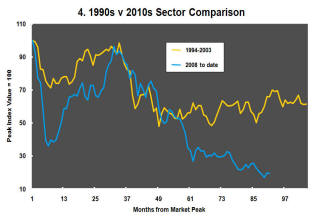

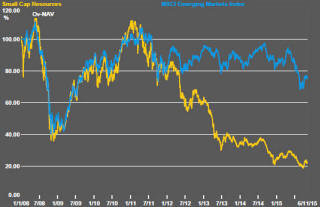

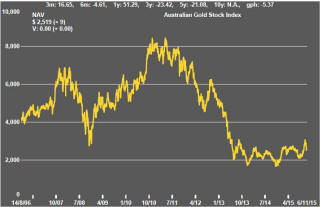

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments. The market is now entering a period prone to even greater disappointment about project delivery .

Has Anything Changed?

The assumption that June 2013 had been the cyclical trough for the market was premature.

Sector prices have adjusted to the next level of support. The parallel with the 1990s illustrated in Chart 4 is being tested. Prices will have to stabilise around current levels for several months for the thesis to hold.

Key Outcomes in the Past Week

The U.S. government reported a 271,000 employment gain in October in its latest labour market report on Friday. The increase was the highest monthly rise in employment since December 2014 and only the eleventh rise in excess of 250,000 since January 2012. The labour report also showed a 2.5% gain in hourly pay rates over the past year.

Only the possibility of a surprisingly poor report for November to be released shortly before the next Federal Reserve board meeting seems likely to derail plans for a December rise in the Fed Funds rate.

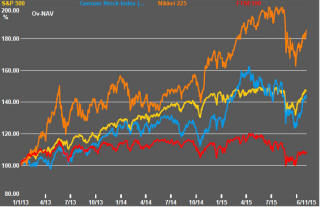

Immediately after the labour market statistics were released, bond yields and the U.S. dollar moved higher as financial markets appeared to be bracing for the long expected rise in rates. The equity market seemed to be taking the possibility of a rate increase in its stride. The S&P 500 volatility indicator fell. Fears about the consequences for emerging market financial stability of rate rises seemed to have disappeared despite the prospect of the same having destabilised markets earlier in the year.

The dollarís strength had immediate consequences for commodity prices. Oil, gold and industrial metal prices fell.

Attention is now turning to what happens after the first rate rise occurs. Federal Reserve governors have said on numerous occasions that the subsequent upward path will be gradual so as to allay financial market fears. This would, no doubt, be their preferred outcome but the speed of future increases may not be entirely their own decision.

With the unemployment rate likely to remain well within an acceptable band, interest will turn to the inflation rate and how closely that is tracking to the Fedís 2% target as the next most important guidepost. Some governors have expressed doubts about the near term achievement of this objective.

Hitting this target will most likely depend on an acceleration in wages growth which remains weak despite the higher rate of growth reported on Friday. This could, however, change rapidly with even modest further tightening in labour market conditions resulting in the Federal Reserve losing control of the timing of further rate rises. Equally, inflation could remain subdued leaving the Federal Reserve hard put to justify further significant rate increases.

Even with wages rising at a faster pace, a strengthening U.S. dollar could limit the inflation impact. This would have an adverse effect on corporate profits and equity prices adding to the pressure on the Federal Reserve to restrain the pace of rate rises through 2016.

Aside from its importance to the interest rate setting task, the U.S. dollar will remain an influence on U.S. dollar denominated commodity prices and, consequently, the performance of resource sector equity prices.

In the past week, resource sector prices were little changed after having given up gains made earlier in the week. The small resources share price index fell 0.4%. The S&P/ASX 100 resources index was unchanged. The Euromoney Global Mining Index, priced after the US labour market report, fell 4.6% after a 3.3% decline on Friday.

. .

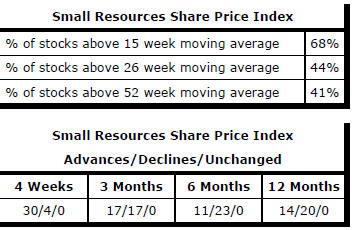

Market Breadth Statistics