The Current View

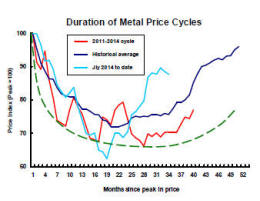

Growth in demand for raw materials peaked in late 2010. Since then, supply growth has generally outstripped demand leading to inventory rebuilding or spare production capacity. With the risk of shortages greatly reduced, prices lost their risk premia and have been tending toward marginal production costs to rebalance markets.

The missing ingredient for a move to the next phase of the cycle is an acceleration in global output growth which boosts raw material demand by enough to stabilise metal inventories or utilise excess capacity.

The PortfolioDirect cyclical

guideposts suggest that the best possible macroeconomic circumstances for

the resources sector will involve a sequence of upward revisions to

global growth forecasts, the term structure of metal prices once again

reflecting rising near term shortages, a weakening US dollar, strong money

supply growth rates and positive Chinese growth momentum. None of the five guideposts is "set to green"

(after the most recent adjustments in December 2016) suggesting the sector remains confined

to near the bottom of the cycle.

Has Anything Changed? - Updated View

From mid 2014, the metal market cyclical position was characterised as ‘Trough Entry’ with all but one of the PortfolioDirect cyclical guideposts - the international policy stance - flashing ‘red’ to indicate the absence of support.

Through February 2016, the first signs of cyclical improvement in nearly two years started to emerge. The metal price term structure reflected some moderate tightening in market conditions and the guidepost indicator was upgraded to ‘amber’ pending confirmation of further movement in this direction.

As of early December 2016, the Chinese growth momentum indicator was also upgraded to amber reflecting some slight improvement in the reading from the manufacturing sector purchasing managers index. Offsetting this benefit, to some extent, the policy stance indicator has been downgraded from green to amber. While monetary conditions remain broadly supportive, the momentum of growth in money supply is slackening while further constraints on fiscal, regulatory and trade regimes become evident.

Leading Economic Indicators

The advanced economies are now displaying positive growth momentum,

according to the OECD leading indicators.

The latest indicators, using data available to the end of January 2017, suggest a sustained modest expansion in Europe without significant improvement in growth rates.

The stronger momentum in the USA and Japan follows a period of weakness suggesting that imminently stronger growth may not prove sustainable.

Several of the principal developing economies are showing signs of improvement after having experienced severe output losses in some cases.

Output in Brazil and Russia is set for modest gains. Chinese indicators are also showing modestly improved momentum. India, on the other hand, is moving through a period of slowing activity.

Sector Returns Stall

Sector equity returns in the March quarter have reflected the loss of

momentum evident in several macro indicators for the resources sector.

Strong equity price gains in the first half of 2016 have tapered off over the subsequent three quarters leaving the sector to show very modest returns more recently despite broader equity market indicators pushing toward or even exceeding previous records.

Stronger returns could be justified against a backdrop of significantly reduced macro risks since late 2015 which have persisted throughout 2016 and which have lifted valuations in other market sectors.

Funding costs for riskier corporates have been falling and selling prices for mine output have stabilised at significantly higher levels since mid 2016.

While the momentum behind these improvements has diminished considerably, pricing for the bulk of the sector has not fully reflected these better conditions.

The current positioning suggests continuing risk aversion among investors but also, perhaps, some disappointment over the shortage of quality investment opportunities.

Retail Employment Highlights Structural

Dislocation

Structural changes affecting U.S. economic performance have been a

persistent theme especially during the 2016 U.S. election campaign when

there was a heavy emphasis on the plight of manufacturing.

On Friday, the U.S. government reported the addition of 98,000 new jobs in March to add to the 16.0 million jobs created since the beginning of 2010 at an average monthly pace of 185,000.

The national unemployment rate is now as low as the U.S. Federal Reserve had thought it could go raising the chance that further employment gains will start to come at a slower pace.

Friday’s data release also highlighted the continuing adjustment faced by U.S. retailers.

The number of retail jobs declined by 29,700 in March. Some of this fall in seasonally adjusted numbers may be due to the timing of Easter but department stores are facing intensifying pressures. Department store employment has dropped by 308,200 since 2010 including over 45,000 since October 2016.

TThe chart shows the switch away from department store employment to growing numbers of people employed in non-store retail enterprises.

The

latter statistical segment includes everything from ebay sellers to sidewalk

vendors. While not all of the gains are technology related, a technology

induced structural shift is making an important and ongoing contribution to

industry restructuring.

The

latter statistical segment includes everything from ebay sellers to sidewalk

vendors. While not all of the gains are technology related, a technology

induced structural shift is making an important and ongoing contribution to

industry restructuring.

Non-store employment has not been enough to soak up the job losses in bricks and mortar stores despite the strength of its growth. /p>

The evident weakness in department stores is one influence on wage growth which is assuming greater importance as an indicator of future monetary policy.

There had been an acceleration in wage growth during 2010-12 when the pickup in non-store employment coincided with relatively stable department store demand for labor.

More recently, the ongoing restructuring of the retail industry has had a more damaging impact on wages outcomes.

Employment in the retail sector accounts for only 11% of overall employment but the changes do illustrate how the pressures on economic structure are more complex than simply the role of China or Mexico when self-inflicted losses reflect everyday decisions by Americans to modify the ways in which they spend their income.