The Current View

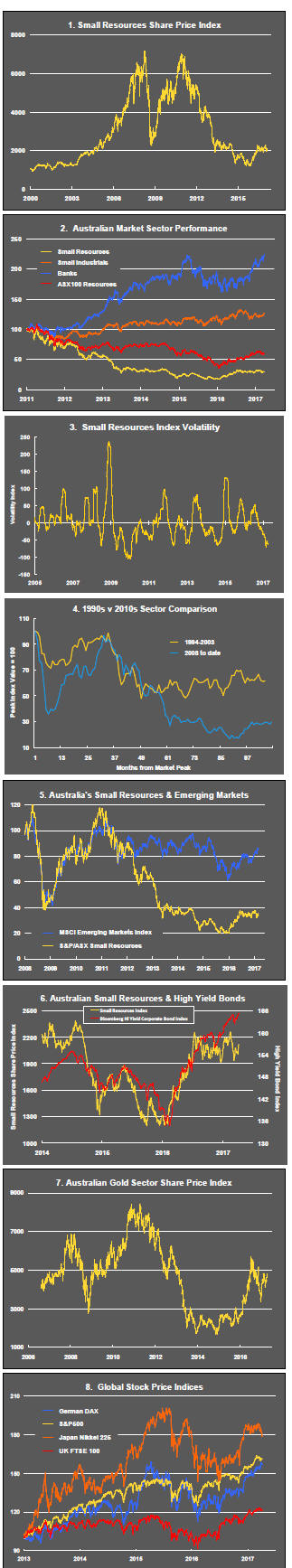

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

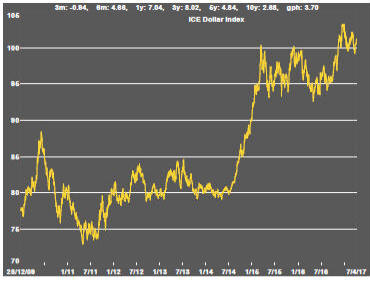

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

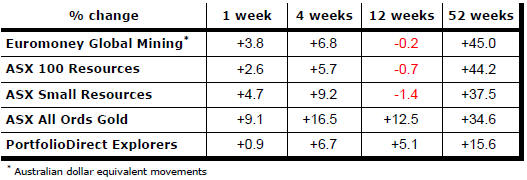

Key Outcomes in the Past Week

Market Breadth Statistics

Geopolitical events loomed large as President Donald Trump appeared to be rethinking many of his attitudes to international problems which had featured so prominently in the 2016 election campaign.

Within a few hours, Trump appeared to have backed away from his isolationist tendencies and opposition to military intervention overseas, dropped any pretence of friendship with Russia, raised the stakes with North Korea and relaxed his demands on China offering the chance of trade concessions if the Chinese government backed attempts to disarm North Korea.

Although market volatility rose, investors generally took the changes in their stride with instances of strong intra day declines being reversed.

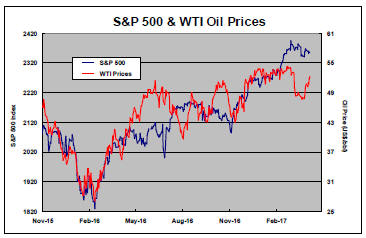

US equity markets have remained fixated on the benefits from tax reform and lowered regulatory burdens promised by the new regime.

Continuing strength in oil prices partly due to renewed speculation about the extension of production cuts added support for equity markets which, nonetheless, have lacked momentum in recent weeks.

Some tendency toward a weaker US dollar evident in recent months was reversed as the geopolitical developments started to unfold.

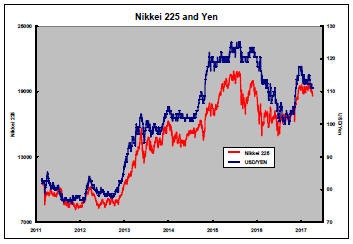

The weaker US dollar had been adding some downward pressure to Japanese equity prices which have a long history of being correlated with currency movements.

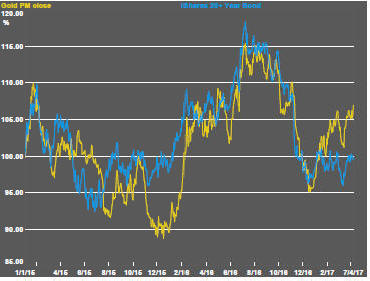

The weaker dollar at the end of the week added upward pressure to gold prices although proliferating international problems could have been expected to add further to the rise in price than they have done.

The direction of bond prices which have also been an important influence on bullion prices have been a more neutral influence leaving the exchange rate to dominate short term movements.

Silver prices have retained their correlation with gold bullion but other parts of the precious metal complex have moved in disparate directions.

The tendency to a lower US dollar should have had a positive effect on raw material prices although that appears not to have happened.

While financial market conditions are supportive of higher prices, the broader macro environment encompassing global growth is not contributing significant positive momentum.

Prices appear to have settled into a higher but relatively stable pattern.

Iron ore prices were the exception in the past week with a dramatic fall in near term prices as demand pressures have eased.

The recent flurry of excitement over the uranium outlook which contributed to strong bottom of the cycle returns among companies highly leveraged to any improvement in conditions has lost momentum.

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.