The Current View

Growth in demand for raw materials peaked in late 2010. Since then, supply growth has continued to outstrip demand leading to inventory rebuilding or spare production capacity. With the risk of shortages greatly reduced, prices have lost their risk premia and are tending toward marginal production costs to rebalance markets.

To move to the next phase of the cycle, an acceleration in global output growth will be required to boost raw material demand by enough to stabilise metal inventories or utilise excess capacity.

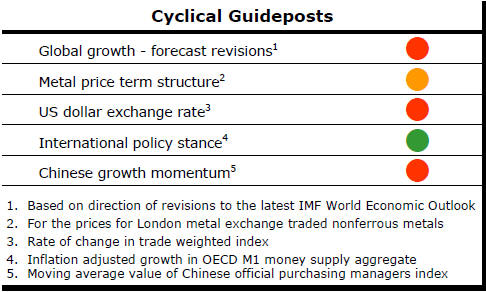

The PortfolioDirect cyclical

guideposts suggest that the best possible macroeconomic circumstances for

the resources sector will involve a sequence of upward revisions to

global growth forecasts, the term structure of metal prices once again

reflecting rising near term shortages, a weakening US dollar, strong money

supply growth rates and positive Chinese growth momentum. Only one of

the five guideposts is "set to green" suggesting the sector remains confined

to the bottom of the cycle .

Has Anything Changed? - Updated View

Since mid 2014, the metal market cyclical position has been characterised as ‘Trough Entry’ as prices have remained in downtrend with all but one of the PortfolioDirect cyclical guideposts - the international policy stance - flashing ‘red’ to indicate the absence of support.

The absence of a global growth acceleration, a stronger dollar and flagging Chinese growth momentum remain critical features of the current cyclical positioning.

Through February 2016, the first signs of cyclical improvement in nearly two years started to emerge. After 15 months of contango, the metal price term structure shifted to backwardation reflecting some moderate tightening in market conditions.

The metal price term structure is the most sensitive of the five cyclical guideposts to short term conditions and could, consequently, quickly reverse direction. Nonetheless, this is an improvement in market conditions and the guidepost indicator has been upgraded to ‘amber’ pending confirmation of further movement in this direction.

Improved Cyclical Positioning

The passage of time is not a sufficient condition for a return to cyclical

strength but it is usually necessary to flush out the more pessimistic

market elements and to achieve some physical rebalancing in response to

weakening demand.

At 29 months into the current cycle, metal markets have now taken around the average amount of time it has taken historically to stop a cyclical price slide.

Price gains through the course of 2016 have resulted in nothing more than an average cyclical position, albeit one greatly improved from the intense weakness evident in late 2015.

Exchange Rate Effects

The U.S. dollar exchange rate has been caught in a 95 to 100 trading range,

as measured by the index measuring the currencies of the major trading

partners of the USA.

Until recently, the exchange rate had been trading

toward the low end of this range which had helped US dollar denominated

commodity prices, including base metals, gold and oil, and U.S. corporate

earnings. Indirectly, this helped to support U.S. equity markets.

Lowered expectations about how high U.S. interest rates would move, and how quickly, added to the downward exchange rate pressures.

The currency has started to move higher partly as the likelihood of near-term rises in U.S. interest rates has gone up.

Ongoing monetary policy measures to stimulate inflation in Europe and Japan are working in a similar direction while the British pound is suffering from post-Brexit fallout.

Should this reversal continue, the beneficial effects of the earlier exchange rate movements will start to unwind.

New IMF Growth Forecasts

There was a hint of good news for resource sector investors in the latest

World Economic Outlook from the International Monetary Fund released on

Tuesday.

For

the first time in four years, the Fund did not cut its near-term global

growth forecasts. It maintained forecasts of 3.1% and 3.4% for 2016 and

2017, respectively, although these had already been lowered several times.

For

the first time in four years, the Fund did not cut its near-term global

growth forecasts. It maintained forecasts of 3.1% and 3.4% for 2016 and

2017, respectively, although these had already been lowered several times.

A genuine cyclical upturn in market conditions is highly unlikely without an output growth acceleration. Cycles happen when the mining industry is caught by surprise and unable to meet an unanticipated upturn in usage rates for its products.

Despite the apparent onset of more stable growth conditions, the IMF research head continued to describe the outlook as “weak” with risks tilted to the downside. He warned that “sub-par growth risks feeding on itself”.

The mix of expected growth has changed marginally with downgrades in the advanced economies offset by upgrades elsewhere. Disappointing growth outcomes in the USA have been offset by better than expected gains in Europe and Japan while stronger than expected Asian growth has been offset by weaker conditions in sub-Saharan Africa.

U.S. Wages Grow Faster

Fear of low inflation is dominating thoughts among policymakers in the

advanced economies.

A wages recession has kept US policymakers on the sidelines despite a strong desire to normalise interest rates to facilitate the conduct of future monetary policy.

Low wages growth has helped restrain inflation

expectations and has contributed to low growth in household spending, both

outcomes which have influenced the Federal Reserve to retain a low interest

rate policy for longer than it would have anticipated.

According to data from the U.S. government on Friday, average hourly earnings grew by 2.7% over the year ended September 2016. This is no wage blowout but was the strongest rate of increase since the beginning of 2010 and most likely solidifies the determination of Fed policy makers to increase the Fed Funds rate in December.

If the rate is not increased in December, anyone could legitimately ask what it would take and the Fed would risk a further erosion of credibility.

For resource sector investors, a rate rise is probably not good news. It is more likely than not to put added upward pressure on the U.S. dollar which would adversely affect US dollar denominated commodity prices.

In the absence of an acceleration in global output growth, the possibility of a downward exchange rate adjustment is the most important single factor that could help precipitate significantly higher raw material prices. But this is more like wishful thinking than a strong analytical possibility.