The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Markets remained enthralled by the same mix of oil prices and central bank murmurings about what they might choose to do in the future.

Oil prices reached their highest levels for more than four months, helping to sustain equity prices, after comments from OPEC members suggested that a deal had been struck to strike a deal later in the year.

The hesitancy over claiming a more definite outcome illustrated that work was still needed. Some saw the possibility of a production cut as Saudi Arabia caving in to their fiscal pressures despite the proposed cutback benefiting Iran, their geopolitical rival.

More sceptical commentators viewed the apparent willingness of the Saudis to reduce production as simply an acknowledgement of what was due to happen in any event.

Markets in the US also seemed buoyed by the rising expectation of the more predictable Hillary Clinton beating the more volatile Donald Trump in the upcoming US presidential election.

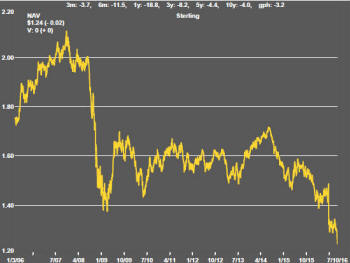

The most dramatic event of the week was of a collapse in the sterling exchange rate to levels not experienced since 1990. The sharp fall on Wednesday showed signs of being the result of a market failure but the trend had been clear as financial markets were adjusting to the decision by UK voters to quit the European Union.

Prime Minister Theresa May spent some time during the week trying to define what Brexit meant.

The

financial services community is arguing strongly to remain part of the

unified European market. Others, for whom immigration reform is the most

important priority, are prepared to give up market access in exchange for

tighter border controls.

The

financial services community is arguing strongly to remain part of the

unified European market. Others, for whom immigration reform is the most

important priority, are prepared to give up market access in exchange for

tighter border controls.

Where the government lands on these choices is unclear. The uncertainty is indicative of the nebulous nature of the proposition put to voters in May.

Currency aside, the effect of the Brexit vote on markets has not been as disruptive as many forecasters had feared. Surveys of UK business continue to point to a future slump in investment but consumers appear largely unperturbed.

The difference in attitude may have arisen because of the majority of people outside the financial services industry and business actually thought leaving Europe was a good idea and were unlikely to be upset in the immediate aftermath of a vote that went their way.

The world’s central bankers and economic policymakers gathered in Washington for the twice yearly meetings of the International Monetary Fund and World Bank.

The bankers continued to opine that governments need to do more to spur growth although they held out little hope of anything different happening.

The meetings came against a backdrop of a weakening global growth profile with senior international policy makers appearing increasingly worried about the populist backlash against trade agreements and global flows of capital.

China’s official manufacturing purchasing managers index held up in September at just over 50 suggesting that output is expanding without giving any cause to believe that the momentum is improving.

Resource sector equity prices were generally lower with gold stocks, in particular, hit by the decline in bullion prices. Gold prices reacted adversely to expectations of higher interest rates in the USA and the evident strengthening in the US dollar.

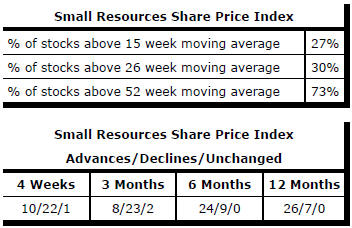

Market Breadth Statistics