The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Markets finished the week with the ideal monthly employment report from the US government.

The employment data was consistent with a steady as you go economic expansion. The 287,000 increase in numbers employed in June was a marked improvement on the (downwardly revised) 11,000 in May but, taken with the May result, showed an economy on a continuing expansion path but not growing so strongly as to raise the chance of a near term interest rate rise.

Prices of all assets seemed to go up on Friday in response to the employment data. Equity prices were higher as were bond prices, the US dollar and gold. Oil was the odd one out.

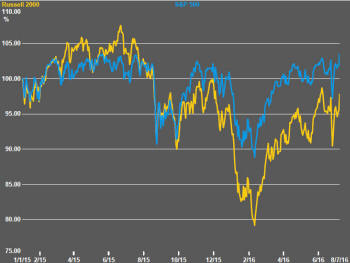

S&P 500 prices returned to near record levels

although the smaller stocks represented by the Russell 2000, and with a

stronger domestic economic exposure, remained short of their earlier highs.

A part of the performance difference between the S&P 500 and the smaller stocks seems attributable to the role of the central bank. The larger stocks do benefit from the ongoing liquidity support. The smaller stocks do not benefit as immediately and are more likely to depend on the real economy and the potential to expand margins through higher prices.

The FOMC members have been incessantly repeating that their decisions about interest rates will be data dependent. In practice, their decisions have appeared event dependent.

Underlying economic conditions appeared ready to support higher rates many month ago but the timing has frequently been interrupted by Greek debt concerns, worries about China’s financial fragility, volatile equity markets and, most recently, the potential impact of the UK vote to leave the European Union.

With bond markets leading rates lower, too, the Fed will have been given the message that it would be running contrary to the market’s interpretation of economic conditions if it chose to raise rates unilaterally at the present time. .

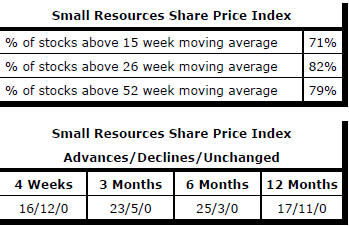

Market Breadth Statistics