The Current View

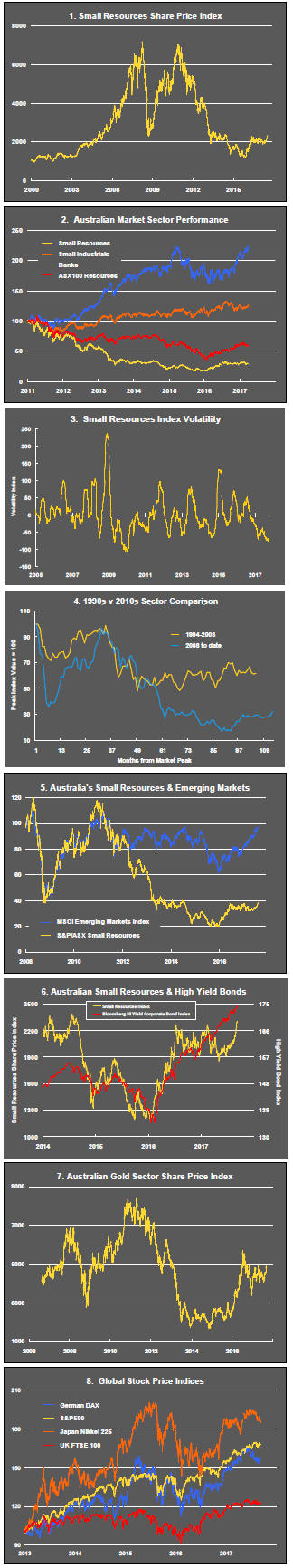

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

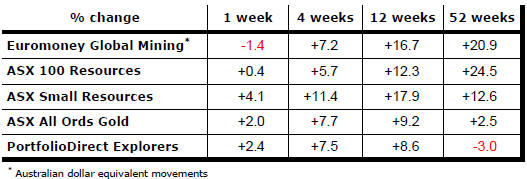

Market Breadth Statistics

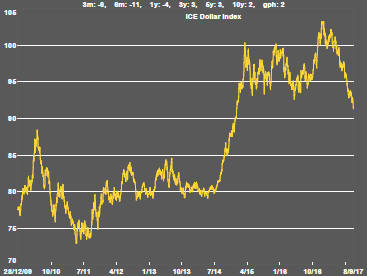

U.S. equity markets pushed ahead although markets in other advanced economies were affected adversely by exchange rates and the threat of nuclear war posed by North Korea.

The tendency for disparate performance among sectors in the U.S. market re-emerged with biotechnology standing out on the upside and telecommunications at the other end of the performance table.

Emerging economy equity prices pushed into the highest levels achieved in the past five years although they have yet to conclusively break through long established trading boundaries.

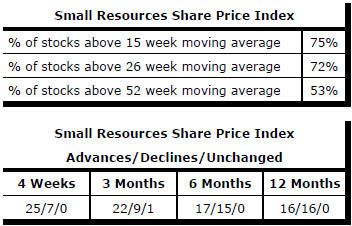

The U.S. dollar has remained the most dynamic of the financial market prices. The lower currency will be benefiting corporate earnings in ways not yet fully felt or included in reported results.

The currency remains a critical ingredient in recently higher raw material prices.

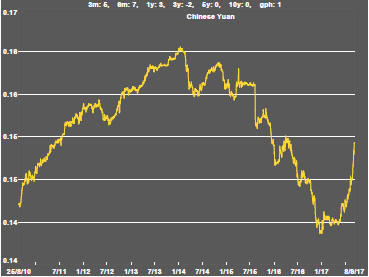

The ongoing appreciation of the Chinese currency (reflected in the U.S. dollar fall) probably helps to ease otherwise acrimonious exchanges between U.S. and Chinese officials about currency manipulation and industrial competitiveness.

Easing commercial tensions may also have a beneficial effect on efforts to find a solution to the standoff with North Korea to the extent the USA needs China to exert more influence on the Koreans. In any event, markets appear to be taking threats of a war on the Korean peninsula in their stride.

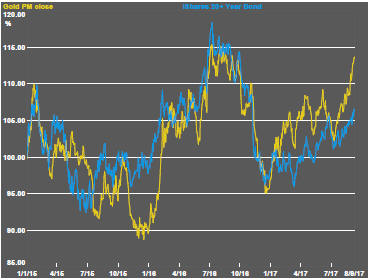

The U.S. dollar and U.S. bond prices have both been moving in the right direction for U.S. dollar denominated gold prices to rise.

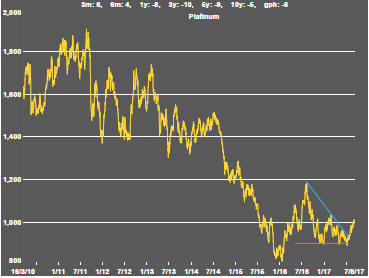

The highest gold prices for nearly a year had not been fully replicated in the prices of precious metals more generally but platinum prices appear to have broken above a persistent downtrend.

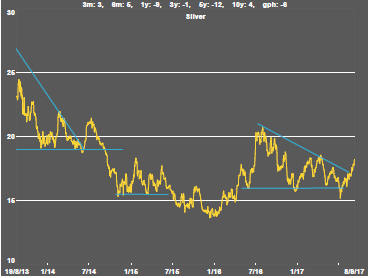

Silver prices have shown a similar pattern to those of platinum in response to the improved precious metal support from the financial markets.

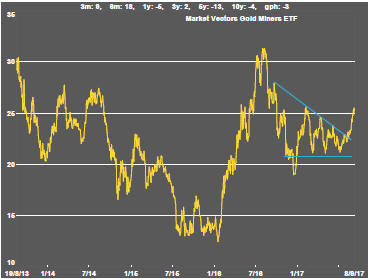

Prices of gold-related equities have duplicated the direction of the recent move in the prices of precious metals although the sector has not displayed particularly strong leverage to the underlying changes.

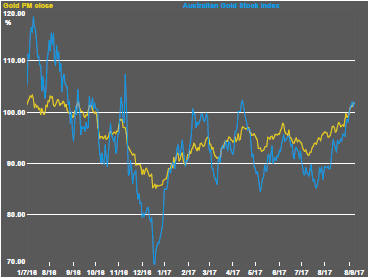

Prices of Australian gold equities have responded strongly more recently after having underperformed bullion prices significantly even after the latter had stated to rise. However, the performance differential between bullion and related Australian equities has been negligible over longer periods of time (e.g. since the start of 2016).

Daily traded base metal prices lost some momentum within the past week. Tin remains the single metal from among the principal non-ferrous metals to have missed out on the recent rally.

The gap between changes in U.S. bond yields and copper price movements has widened.

The role of copper as an indicator of economic dynamism is at odds with the bond market's apparent discounting of stronger growth and inflation.

History would suggest that this divergence in interpretation is not sustainable and largely driven by financial market factors rather than developments in the real economy .

Iron ore prices which are less well connected to financial market conditions seem to have stalled.

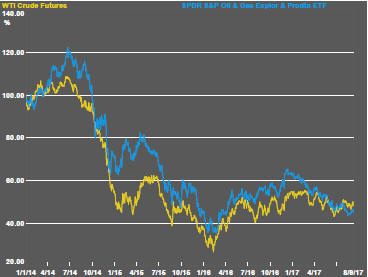

Oil market conditions have stabilised but have responded little to the currency changes affecting prices of other commodities. Related equity prices have improved only slightly in the past week.

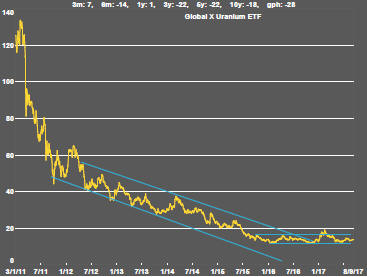

The uranium sector remains in a prolonged cyclical trough after a lengthy downtrend from which there is little sign of recovery.

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.