The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Market Breadth Statistics

Crude oil prices continued to edge lower with building concerns about adverse market balances. Oil and gas related equity prices - generally leveraged to changes in crude oil market conditions - suffered disproportionately.

Among the most noticeable features in equity markets during the week was the differing performance between banks and technology sector stocks.

Prices of some of the largest technology stocks appeared to have hit a valuation ceiling after having been driven over the past 18 months by the potential for strong revenue growth from disruption of traditional industries.

Prices of bank sector stocks had been languishing after having been boosted by the election of Donald Trump and his promises to reduce regulations applying to the sector. More recently, doubts had arisen about the legislative effectiveness of the Trump administration and the Republican Party majorities in the U.S. Congress leading to lowered expectations about the efficacy of any new measures.

Modifying optimism about the scope for deregulation has been a narrowing spread between short term and long-term interest rates as expectations of policy adjustments rise.

Relatively strong shorter term bond yields have reflected expectations that the Federal Reserve was on the verge of another rise in the Fed Funds rate when its policy committee meets in the coming week. At the same time, longer dated yields appeared to have reflected only moderate growth and inflation expectations leading to a flattening yield curve.

Investors will be looking for any change in Fed attitudes toward the trajectory of future interest rate rises and for guidance about its balance sheet management over the next few years following the upcoming meeting.

With confirmation that the Fed has set its course to reduce monetary accommodation, more emphasis may be placed on whether the Fed's plans are too aggressive for the state of the economy with GDP growth still struggling to beat 2% and partial indicators being inconsistent with a clear-cut acceleration in activity.

Among the principal metal prices, the strong divergence between copper and iron ore prices persisted.

The difference in performance between prices of these two metals which dominate the incomes of the market leaders with their ambiguous implications for earnings helps explain weakness in recent weeks among the largest stocks in the sector.

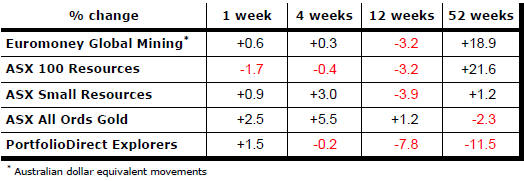

Sector share price weakness is evident across the board but, over the course of the last 12 months, the smallest stocks in the sector - those whose primary activity is mineral exploration - have been among the heaviest losers.

The sector as a whole has largely missed the effects of more buoyant equity markets over the past year with price gains having been concentrated among the larger stocks which have a stronger correlation to broader equity market influences.

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.