The Current View

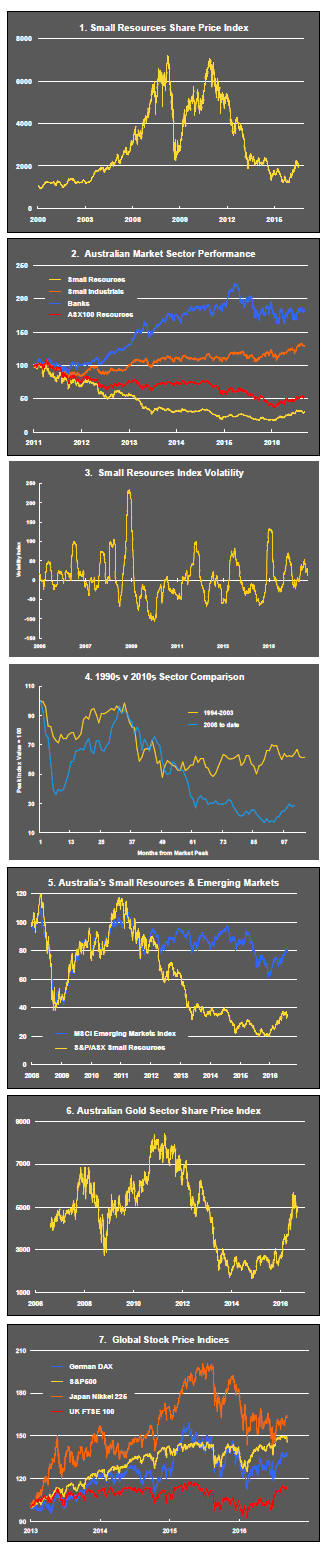

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Oil prices, Federal Reserve policy and investor skittishness again combined to dominate market outcomes.

The week closed dramatically with a 2.3% decline in the S&P 500 after a succession of Federal Reserve speakers had seemingly pointed the way to a near term interest rate rise.

A single rise of 0.25 percentage points should not make a fundamental difference to valuations or growth or sales outcomes.

The reaction of markets to such a minor potential change indicates the extent of market nervousness presently about valuations based on earnings. Fears of a lapse into recession from a series of rate rises also play into these reactions.

The plethora of Fed speakers is aggravating the tendency of traders to anticipate clues about future policy. With several speakers scheduled to opine publicly on the interest rate outlook in the early part of this week (before the black-out period leading to the next FOMC meeting), further large swings in market prices may occur.

Markets have also been looking to central banks in Japan and Europe for modifications to their policies. In each case, hints of more active asset buying programs have not been realised making traders increasingly concerned about whether the central banks believe any longer in their capacity to affect asset prices.

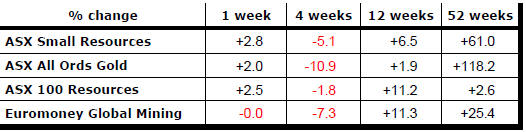

Improved ASX resources sector prices during the week came before Friday’s sell-off in Europe and the USA. Weaker Australian equity prices can be expected when markets reopen on Monday.

Generally, resource sector prices appear to have lost momentum. Having recovered from late 2015 price losses, selling pressures arising in response to unusually strong sector returns have not been offset by the necessary infusion of new investors into the sector to take up the slack.

The late-week sell-off came with slightly lower oil prices but, through the week, oil prices had risen. Lower than expected U.S. terminal inventories had sparked fresh buying of oil price futures.

While the oil inventory rundown was construed as a bullish sign for the world market, tropical cyclone Hermine has apparently delayed vessels trying to unload oil imports on the U.S. gulf coast. The delaying effect of the weather conditions suggests a strong possibility of the inventory rundown being reversed within a few days with an imminent return to possibly weaker prices in the week ahead.

Among other unusually strong market moves, the U.S. dollar closed 0.6% higher than its low point earlier in the week. The 10 year U.S. government bond yield rose 13 basis points. At 1.67%, the yield on Friday was the highest since the third week in June.

Any widening in the spread between short and long-term interest rates should benefit financial sector equity investments (and possibly delay any potential flow of funds to resource sector investments). The continued elevation in the U.S. dollar keeps a lid on U.S. dollar denominated commodity prices.

The mix of influences pushed gold prices lower in the latter part of the week. Iron ore prices, which had begun falling a week before, continued on a slight downtrend. Renewed weakness in the energy sector came after more evidence of an ongoing market surplus. By the end of the week, however, some hope had emerged of renewed production constraints.

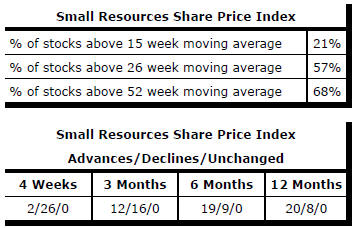

Market Breadth Statistics