The Current View

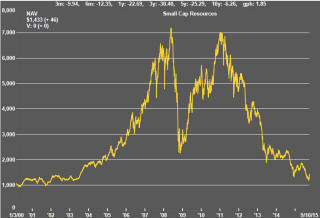

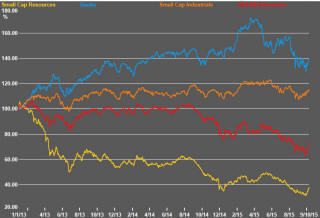

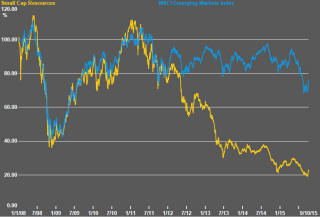

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments. The market is now entering a period prone to even greater disappointment about project delivery .

Has Anything Changed?

The assumption that June 2013 had been the cyclical trough for the market was premature.

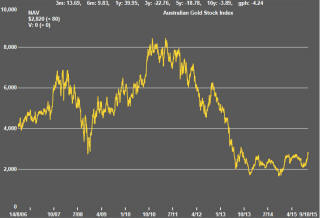

Sector prices have adjusted to the next level of support. The parallel with the 1990s illustrated in Chart 4 is being tested. Prices will have to stabilise around current levels for several months for the thesis to hold.

Key Outcomes in the Past Week

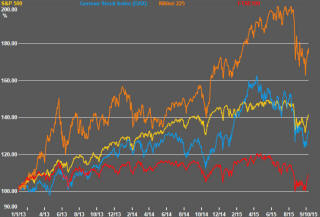

Markets staged a largely inexplicable whipsaw reversal through the week. Investors seemed attracted to the stocks and sectors, including resources, which had performed worst in the September quarter.

Resources stock prices were broadly higher. The ASX small resources share price index rose 13.9%. The S&P/ASX 100 resources index added 13.8%. The Euromoney Global Mining Index increased 17.4%.

Federal Reserve governors had decided in the previous week not to raise interest rates. Otherwise, market influences seemed to differ little. U.S. corporate earnings were set for their second consecutive monthly decline. Chinese economic growth remained in transition to permanently lower rates. European growth, which had risen, has appeared to lose its upward momentum. None of these factors individually or in combination appear to warrant the observed change in market sentiment.

An outside chance of another round of quantitative easing in the USA appeared to be the only change that might have encouraged the surprise display of market optimism. But even that did not make much sense. Quantitative easing has had little impact on real growth. Resource sector equity prices declined throughout the period in which quantitative easing was applied most vigorously.

Prices of all the principal daily traded nonferrous metals - aluminium, copper, lead, nickel, tin and zinc - rose during the week. Gains ranged from 4% to 10% with zinc and lead coming in at the upper end. Gold prices rose 2%.

Crude oil prices rose 8%. A part of the oil price increase was due to heightened fears about supply disruptions in the Middle East due to intensifying military conflicts. The stronger oil price had a beneficial effect on the broader market as it contributed to higher earnings.

The metal price changes were a welcome respite from persistently weak markets but, as the chart on page one depicting the duration of metal price cycles shows, the market position remains consistent with attempts to find a bottom which has not yet been reached.

The zinc market benefited from Glencore’s announcement that it would reduce its output of zinc by up to 500,000 tonnes because excess supplies were depressing prices. Oddly, Glencore had been leading the zinc cheer squad with a range of junior zinc miners using its analysis of the zinc market to attract investors.

The Glencore move could yet prove telling. So ill-timed have such decisions been in the past that it could be taken with some confidence as a sign of a nearby cyclical bottom.

Prices remain anchored near cyclical low points. The large gains reflect typical bottom of the cycle leverage. One cause for optimism is the breadth of the price reaction which is more typical of a cyclical upturn or a bottoming out process.

The open question after the week’s rally is whether the demand for risk will carry further into the end of the year. As long as the near term preparedness to incur risk is simply a readjustment to excessive prior selling, the answer will most likely be “no”. The stronger commodity prices and their associated equities remain on parlous ground if they are relying on the support of a Federal Reserve clearly committed to raising interest rates at the first opportunity.

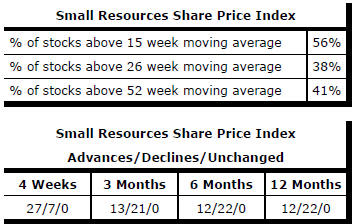

Market Breadth Statistics