The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

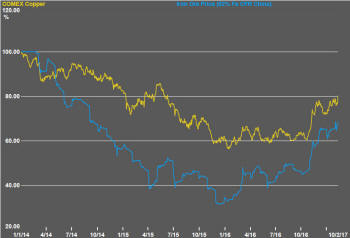

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Market Breadth Statistics

Donald Trump was once again given the benefit of the doubt as the main U.S. equity market indicators broke new records.

Although still largely undefined moves toward less regulation, lower taxes and higher infrastructure spending were given credit for the stronger US markets, equity price gains have been widespread enough to suggest a widening optimism about global growth prospects.

A friendly meeting between Donald Trump and Japanese prime minister Abe appeared to alleviate some concerns about the emergence of damaging global trade rivalries.

The U.S. dollar finished the week on an uptick after a succession of falls partly linked to the impact on global trade of policies foreshadowed by the Trump administration.

The lower currency, along with greater optimism about the state of the world economy, continued to benefit commodity prices. Higher copper and iron ore prices benefited the leading stocks in the sector.

The uranium segment of the market which had for so long been a laggard made further gains. The leverage among uranium stocks to improved conditions remains among the strongest for investors in the sector.

Indicative of the more risk friendly attitude, yields on the lowest rated corporate bonds continued to track lower in an important signal for the resources sector about the availability of finance.

Within the commodity equity space, examples persist of prices having improved from late 2015 but facing headwinds in trying to push past the price level which had prevailed in the early part of 2015.

The evident resistance to a move higher shown in the chart of the small resources share price index in the right hand panel is indicative of this challenge. One might have expected sector equity prices outside the leaders to have strengthened more markedly as the financial indicators showed a stronger appetite for risk.

The price action in the sector (and outside the largest stocks which have been more closely tied to global equity market conditions) suggests the sector is now underperforming its potential .

The scene is being set for stronger investment returns at some stage during 2017 for the middle of the range companies in the sector, provided the improved global growth conditions persist.

The exploration end of the market, which also falls into this category, is likely to be the last part of the market to shift and, once that happens, the surest sign that cyclical progress has been made.

.

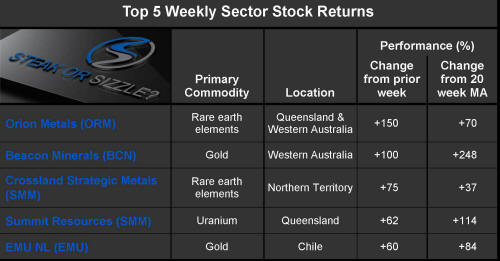

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.