The Current View

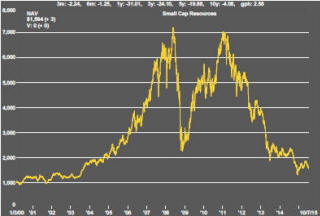

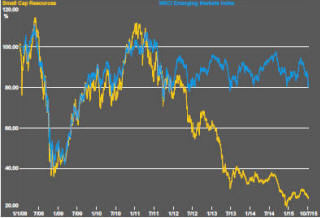

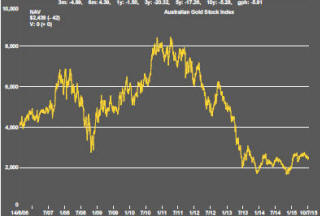

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments. The market is now entering a period prone to even greater disappointment about project delivery .

Has Anything Changed?

The assumption that June 2013 had been the cyclical trough for the market now appears premature.

Sector prices have adjusted to the next level of support. The parallel with the 1990s illustrated in Chart 4 is being tested. Prices will have to stabilise around current levels for several months for the thesis to hold.

Key Outcomes in the Past Week

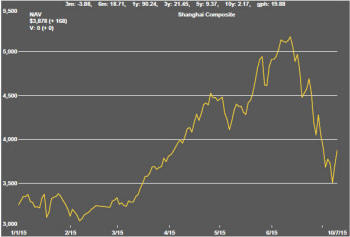

Three of the world’s trouble spots appeared to have become less of a headache at the end of the week. Greece had submitted a new set of policy measures designed to appease its creditors. Chinese stock prices had stopped their daily descent. Iran was closer to an agreement with its interlocutors over its use of nuclear power that would free it from damaging economic sanctions.

In each case, there were grounds for scepticism about whether the state of play on Friday represented meaningful progress or simply another source of eventual disappointment but equity markets appeared to look favourably on the emerging outcomes.

In the USA, the S&P 500 finished the week where it had

finished the prior week but there was a 41 point range in between and a 1.3%

move on the last day of the week. The German market also seemed to sense a

benign outcome in its neck of the woods with a 6% increase over the last

three days of the week. The Shanghai composite share price index rose 10.6%

over the last two trading days.

Prospects of an agreement between Greece and the rest of Europe attracted support for the euro which rose 1.4% over the latter days of the week but financial markets seemed generally less enamored with the outlook for risk.

U.S. bond yields rose 20 basis points to finish near the 2.4% mark which has formed the upper end of a trading range over the past month. Similarly, German bonds added 25 basis points to also return to the upper end of their recent trading range.

The Australian dollar - now widely regarded as a trading

proxy for the state of the Chinese economy - moved little despite other

signs of market optimism to finish below 75 U.S. cents and near the low

point in the cycle reached earlier in the week.

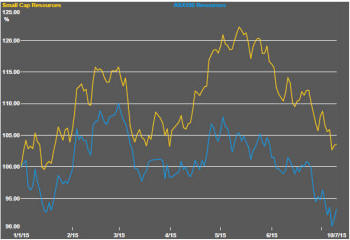

The small resources share price index fell by 2.8%. The S&P/ASX 100 resources index fell 1.1%. The small resources share price index has returned to levels at which it traded in November 2014 but the index covering the largest stocks in the sector has been faring worse. It traded at a new cyclically low level as iron ore prices remained volatile but also showed no sign of a cyclical improvement that would benefit the large miners.

Since much of the public commentary about iron ore markets has been around the idea that prices may not recover in the foreseeable future, some reconsideration of the underlying value of the two largest companies in the sector seems inevitable.

Market Breadth Statistics