The Current View

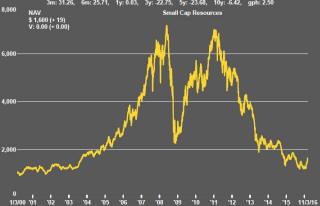

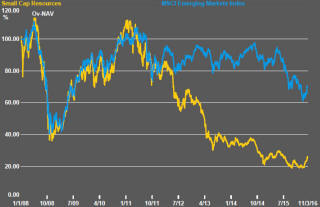

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

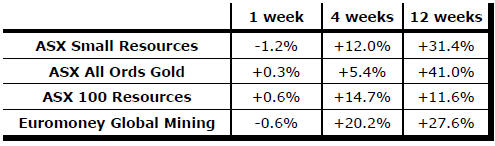

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

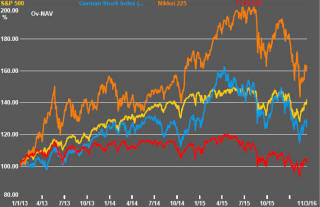

U.S. equity prices continued to track oil prices as the latter moved higher through the week. There is no compelling reason for the relationship to persist. In fact, the reverse could just as easily hold since global growth should benefit from low oil prices. For the time being, however, higher oil prices are being taken as a sign of improving global demand and reduced US financial market risk.

Oil prices have been on the rise since the United Arab Emirates oil minister talked about a production freeze on 11 February. This happened against a backdrop of an oversold market, contributing to the strength of the resulting price reaction. Since there has been no meaningful physical adjustment to underpin improved prices, the market remains vulnerable to a failure to follow through on the promise of output restraint.

Higher oil prices are likely to sustain US production for longer than would otherwise be the case as it is among the most price sensitive sources of global output. That sensitivity may diminish over time if U.S. financial institutions have become more reluctant to lend to the industry but, until then, there will be pressure to maximise production to meet debt repayment obligations.

The short term impact of Iran may also be of diminishing importance. Stored Iranian crude supplies will have been released quickly after the removal of international sanctions leading to a return to more sustainable levels of output once the stocks had been cut.

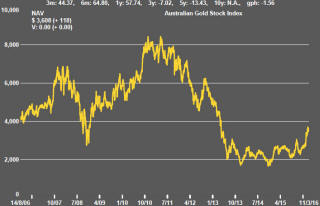

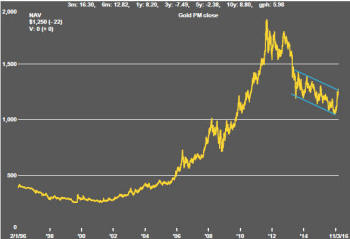

The

U.S. dollar gold price has remained within its medium term downtrend after

having hit the upper end of the trading channel this month.

The

U.S. dollar gold price has remained within its medium term downtrend after

having hit the upper end of the trading channel this month.

The rise in the gold price will have been supported by expectations of negative interest rates but these adjustments have proved less dramatic than their announcements had intimated.

More aggressive implementation of negative interest rates would benefit gold prices but, against that, three rises in U.S. interest rates are expected during the remainder of 2016. Realisation of this possibility (or even its expectation until proven otherwise) would most likely put downward pressure on the gold price.

The rise in the U.S. dollar dating from mid 2011 has stalled with no net change, when measured against its major trading partner currencies, for almost one year. Despite the loss of momentum, the prospect of higher U.S. interest rates during the remainder of 2016 tips the balance of risks for the currency toward the upside.

U.S. dollar denominated metal prices have benefited from the slackening currency pressure. As a result, metal prices have moved closer to average cyclical outcomes.

The slowed pace of the dollar’s ascent has also caused some retracement of emerging market currencies with the Brazilian real and Russian ruble having also benefited from improved commodity prices.

The Australian dollar has risen 6% since the end of February. The impressive rally highlights the currency’s considerable leverage to even modest improvements in raw material market conditions. .

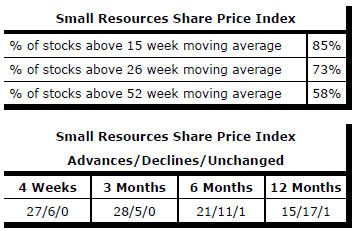

Market Breadth Statistics