The Current View

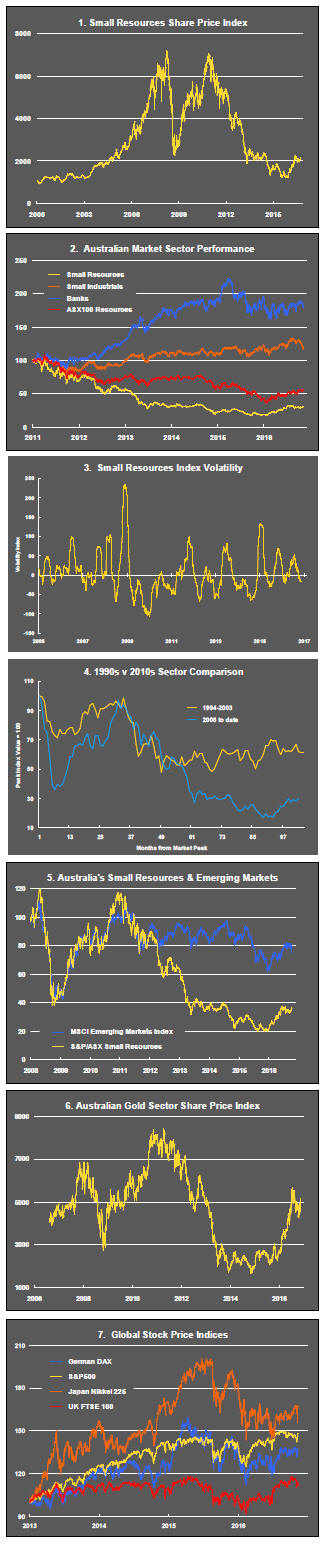

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

The week’s financial market news was dominated by the election victory of Donald Trump over Hillary Clinton.

Market responses to Trump’s election were dramatic although one needs to be careful about how much should be attributed to Trump’s victory and how much credit should go to the Republican Party winning the Senate and House of Representatives in addition to the presidency.

The clean sweep (including the implications for the composition of the Supreme Court) is potentially far more significant than the onset of the Trump presidency alone.

Contrary to the pre-election conventional wisdom that Clinton was the preferred candidate among professional investors, new equity price records were set in the aftermath of the election which resoundingly endorsed Republican Party candidates at all significant levels of government.

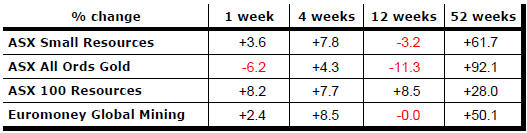

Amongst the most significant moves, equity prices rose, bond prices fell, metal prices other than gold increased, the U.S. dollar moved higher, biotech prices dropped and emerging market equity prices declined. Lower oil prices came with reduced confidence that OPEC will be able to engineer a cut in output to sustain higher prices.

Consistent

with higher industrial metal prices, sector equity prices generally rose

although the prices with gold exposure declined.

Consistent

with higher industrial metal prices, sector equity prices generally rose

although the prices with gold exposure declined.

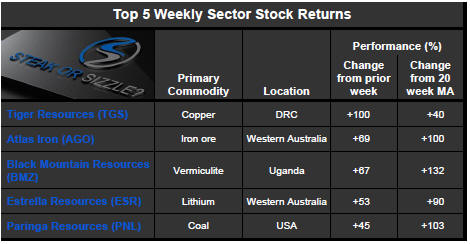

The trend in recent weeks toward coal producers gained momentum with a reappraisal, too, of companies with exposure to iron ore and copper against the backdrop of significant gains in the prices of these commodities.

Whether the overall macro environment is robust enough to sustain the improved metal price sentiment remains uncertain without any significant improvement in global output growth.

Arguably, the outlook is little better than it had been although the Trump presidency holds out some hope of greater metal intensity in U.S. public and private sector investment spending in the years ahead.

Europe, Japan and China appear little changed by what has been happening in the USA with some concerns that improved U.S. growth could come at the expense of growth elsewhere as the U.S., led by the new administration, battles for an increased share of global trade.

Anxiety over the impact on trade of the new administration was evident in the reaction of investors to emerging market equity prices.

The U.S. Federal Reserve seems more likely to raise interest rates in December given the positive market reactions to a Trump victory. In any event, financial markets have run well ahead of the Fed with bond yields having added 0.79 percentage points since their nadir in July 2016.

.

The Steak or Sizzle? blog LINK contains additional commentary on the sources of the share price performance among the best performed stocks and the extent to which these near term investment outcomes might be underpinned by a strong enough value proposition to sustain the price outcomes.

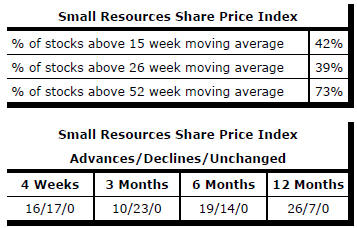

Market Breadth Statistics