The Current View

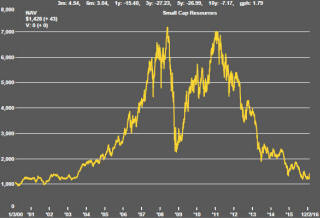

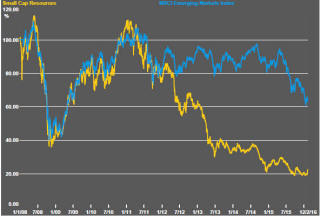

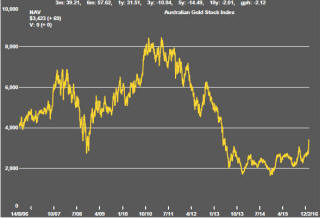

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments. The market is now entering a period prone to even greater disappointment about project delivery .

Has Anything Changed?

The assumption that June 2013 had been the cyclical trough for the market was premature.

Sector prices have adjusted to the next level of support. The parallel with the 1990s illustrated in Chart 4 is being tested. Prices will have to stabilise around current levels for several months for the thesis to hold.

Key Outcomes in the Past Week

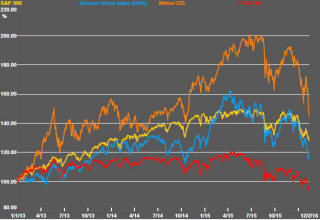

U.S. equity markets mounted a partial recovery on Friday after five consecutive days of decline. The apparent sentiment swing raised some hope that market conditions were stabilising after being sold down by 12% since the end of December.

While similarly heavy falls had occurred on previous occasions since the 2009 cyclical trough, subsequent recoveries had come rapidly. On this occasion, market sentiment about global growth and the intensifying negative impact on financial institutions appears to have been less supportive. In particular, steps to lower interest rates generally and push some below zero have adversely affected the profitability of banks and stoked investment market pessimism about their risk profile.

The catalyst of the market recovery on Friday leading into a long weekend in the USA was hard to discern but coincided with reports that Deutsche Bank plans to repurchase more than US$5 billion in outstanding bonds over whose value some doubts had been expressed. Also, Jamie Dimon announced that he had purchased JP Morgan shares valued at US$27 million with his own funds. Both moves were taken as positive indicators of the financial condition of the banking sector which had been among the largest market losers.

In the background, the flow of U.S. domestic economic data was supporting improved sentiment. The consumer, in particular, seemed in relatively good shape. Retail sales increased 0.3% in January. With 10 year bond yields dropping to as low as 1.53% last week, housing affordability is set to improve further. Wages, which showed a 0.5% gain in January, have started to grow slightly faster than their sluggish pace over recent years.

Consistent with the strength of the consumer, the Federal Reserve Bank of New York reported a very modest rise in household debt over the December quarter. The 5.4% of outstanding debt in some stage of delinquency was the lowest rate reported since the second quarter of 2007.

On the negative side of the ledger, U.S. manufacturing conditions have been damaged by the strength of the US dollar. Even that pressure, however, has appeared to ease. The U.S. dollar returned to levels which had prevailed in October after declining against the index of US major trading partner currencies since late January. Weakness in the oil sector persists with adverse regional employment impacts and a detrimental effect on aggregate capital spending.

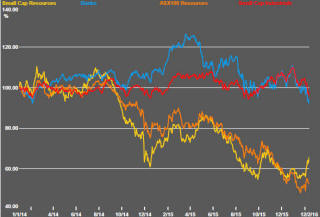

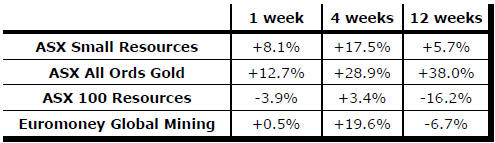

Within the resource sector, the smaller end of the

market continued to gain ground helped by the equity response to a higher

gold price. The potential loss of dividend at the bigger end has also

helped the process of performance convergence.

Within the Australian equity market, the process of convergence between resources and industrials continued and while the historical gap remains large, the competitiveness of the latter has been eroded with the banks and smaller industrials segments both slipping under their prices at the start of 2014.

Pursuit of financial safe havens has also lent support to gold prices which have risen from as low as US$1060 at the end of December to over $1260/oz in the past week. The 5.5% gain in gold bullion prices over the past week was welcomed by gold miners. The Market Vectors Junior Gold Miners ETF added 14.2%. However, the net result leaves bullion prices within the downtrend which has been in place since 2012. At the end of the week, the gold price had shown insufficient momentum to break this barrier.

Market Breadth Statistics