The Current View

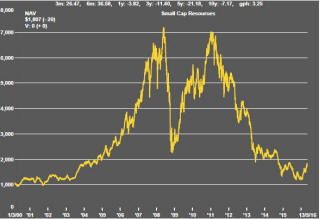

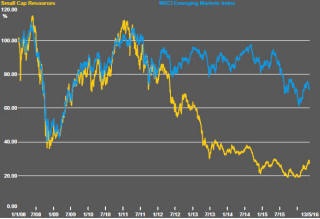

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

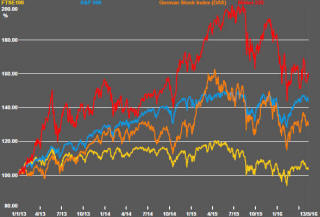

The correlation between oil prices and the S&P 500 which had dominated market sentiment for several months has continued to weaken as equities have failed to keep up the pace.

Whether or not oil prices also slide lower, the intensity of the connection appears to have diminished with investors now more accepting that the two prices are being driven by separate influences.

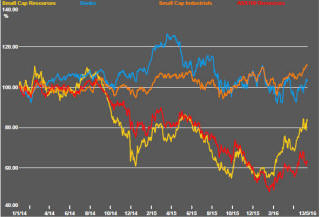

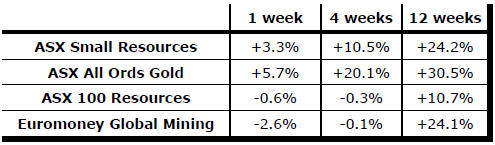

The smaller end of the resources market encompassing gold stocks performed relatively well.

Among the strongest influences on resource sector investment outcomes in the past week were signs of a stronger U.S. dollar exchange rate, a slight easing in gold prices, a pickup in sector share price volatility and mixed interpretations about the significance of U.S. retail sales data.

The U.S. dollar index added 0.8% for the week after touching the lowest rates since January 2015 earlier in the month.

With expectations that U.S. interest rate movements would run ahead of policy moves in Europe and Japan, the bias in sentiment is toward a higher U.S. dollar. The reappraisal of the extent of likely interest rate rises in 2016 which has occurred in the first months of the year appears to have been fully taken into account leaving commodity prices - still relying on a weakening U.S. dollar for further upside - awkwardly poised.

The gold price tracked slightly lower over the week although, somewhat surprisingly, it rose on Friday when the U.S. dollar was also moving higher.

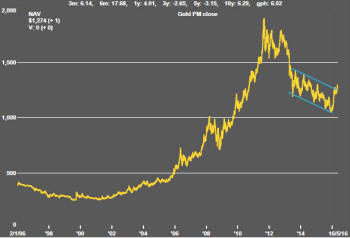

The

gold price appears to have broken through the upper end of the downtrend

which had been in place for the past three years. This may be enough to

convince some buyers of gold assets that there is enough momentum for prices

to break the currency connection over the medium term. But the jury is still

out on that judgment with many competing financial market factors in play.

The

gold price appears to have broken through the upper end of the downtrend

which had been in place for the past three years. This may be enough to

convince some buyers of gold assets that there is enough momentum for prices

to break the currency connection over the medium term. But the jury is still

out on that judgment with many competing financial market factors in play.

Within the Australian resources sector, there has been a pickup in price volatility. That is normally a negative sign for sector share prices. On balance, PortfolioDirect would infer heightened downside risk as long as the measure of sector volatility displayed in Chart 3 in the right hand panel is on the rise.

U.S. retail sales, as reported by the Department of

Commerce, rose 1.4% in April. This was the largest monthly increase since

March 2015 immediately spurring thoughts about the need to revisit prospects

for interest rate rises.

The stronger growth, taken on its own, could be interpreted as a speeding up of recovery from weak conditions in the first quarter, possibly prompting some in the Federal Reserve to opt for a more aggressive sequence of tightening than the market had started to assume.

Despite the optimistic tone implicit in the data, however, the growth in the nominal value of retail sales over the year was only 2.7%. With competitive pressures from online selling continuing to restrain the profitability of department stores and other bricks and mortar retailers which have been reporting poor earnings outcomes, the generally subdued retail sales growth picture suggests that the inflation argument for higher interest rates is not particularly strong.

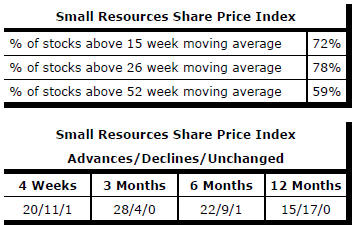

Market Breadth Statistics