The Current View

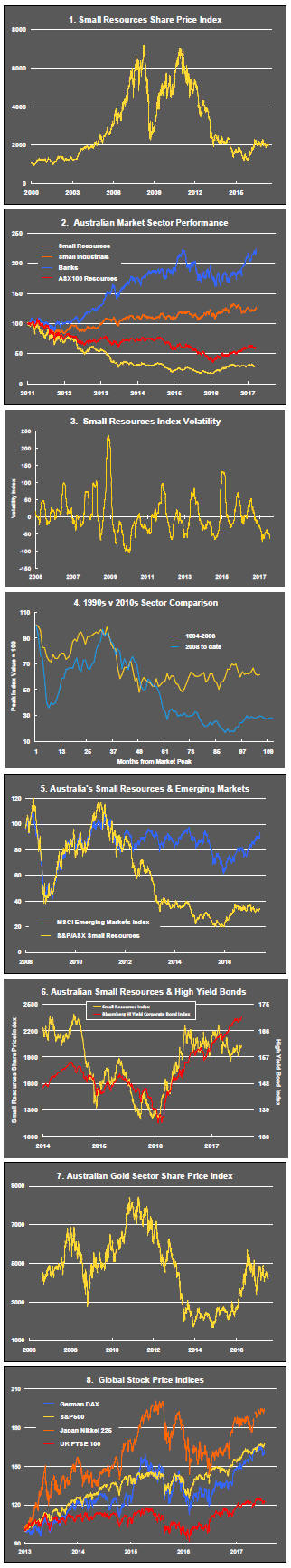

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Market Breadth Statistics

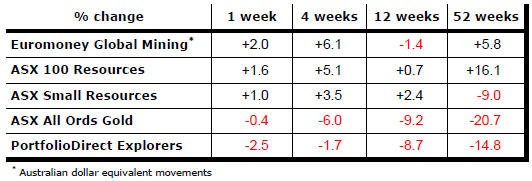

A reassessment of relative growth and financial return indicators is occurring with implications for the direction of commodity prices.

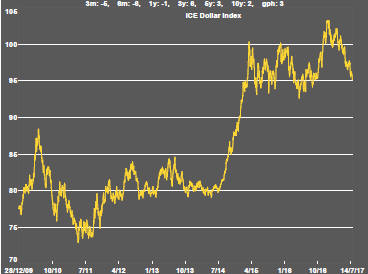

The direction of the U.S. dollar has been driven by an assumption of relative economic strength accompanied by rising interest differentials favouring U.S. financial assets.

As the prevailing assumptions have broken down, the U.S. dollar has reversed gains made since mid-2016.

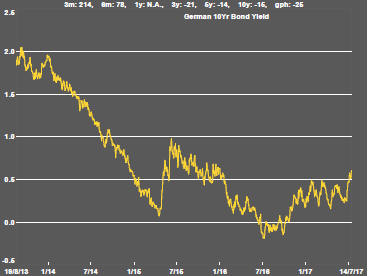

Rising European bond yields based on changed views about the duration of easy money policies are one sign of the market readjustment.

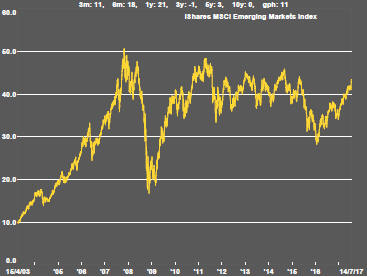

Emerging markets have also been attracting more interest as their relative valuations have improved against the backdrop of record prices being paid in the markets of advanced economies.

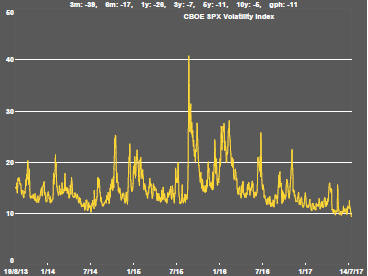

Implied equity market volatility dropped sharply and to unusually low levels during the week to highlight the perceptions of generally reduced risks.

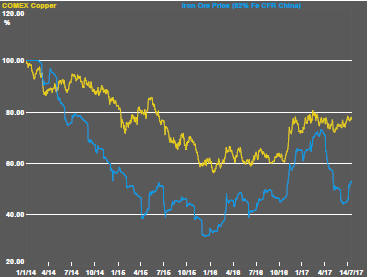

The lower U.S. dollar has helped support metal prices although the magnitude of the gains has varied from commodity to commodity as underlying market balances have modified the extent to which prices have responded to the currency adjustment.

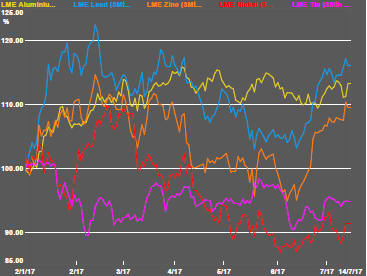

Lead and zinc prices have continued to perform more strongly than aluminium and nickel prices, among the key non-ferrous metals.

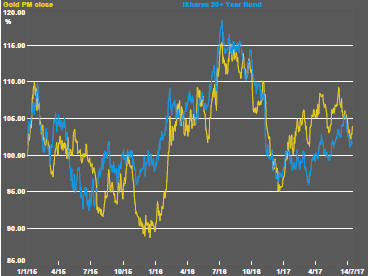

The beneficial effect of the weaker U.S. dollar on gold prices has generally been offset by the fall in U.S. bond prices although the direction of both changed slightly in the latter part of the week.

Gold-related equity prices are showing signs of stress with a rising risk of a sharply negative reaction to even minor falls in gold bullion prices.

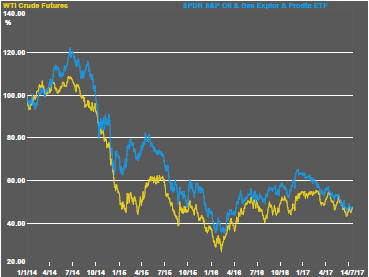

Although crude oil prices continue to battle oversupply headwinds, downward pressures have appeared to moderate with marginally stronger conditions in the past week also stalling the fall in energy related equity prices.

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.