The Current View

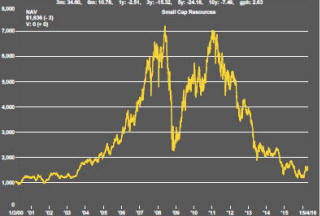

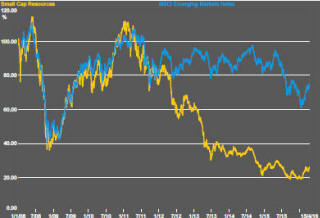

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

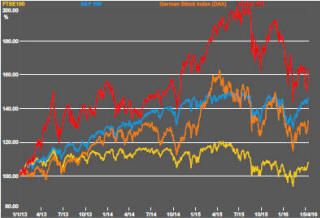

The break in the oil price-equity price nexus has proved short lived. There was money to be made a fortnight ago betting that the gap would be closed and that the two markets would resume their close trading connection.

The PortfolioDirect market commentary over several weeks has been pointing out the absence of any sound analytical reasons for oil and equity prices to move in lockstep. Rapid rises in both had made it increasingly likely that a break would occur sooner rather than later in favour of equity prices. There were more reasons supporting higher equity prices than for oil to continue the upward trend.

Comments by Federal Reserve governors remain influential factors week to week in setting the tone for the market. In particular, Janet Yellen herself has seemed to downplay the extent to which further interest rate rises will occur in 2016.

Yellen has seemed to reinforce the evidence that the state of the U.S. economy did not warrant higher interest rates. Growth has not been excessive and inflation, although expected to edge higher, has not appeared to be rising to any material extent.

The less hawkish interest rate tone from the Fed has removed some upward pressure on the U.S. dollar exchange rate. That, in turn, has moderated the downward pressure on commodity prices.

Continuation of firm employment growth has reinforced the positive equity market sentiment. At the same time, the U.S. purchasing managers index has provided its first reading above 50 in six months.

Equity prices seem to have entered a benign patch with moderately good news on the activity front but not such good news as to push the Fed into raising interest rates more aggressively than the governors had planned. The balance, at least presently, seems about right.

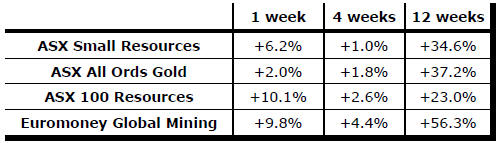

Resource sector outcomes have remained generally positive with the largest companies in the sector having picked up momentum over the past week. Among the smaller companies, sometimes large gains reflect bottom of the cycle leverage in relatively illiquid markets.

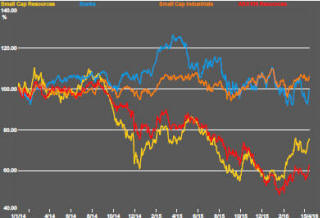

The

larger companies are now benefiting from a flow of funds into the sector

from generalist investors reappraising its absolute and relative

attractiveness. The choice between banks and resources for Australian

investors is no longer as one sided as it had been for several years.

The

larger companies are now benefiting from a flow of funds into the sector

from generalist investors reappraising its absolute and relative

attractiveness. The choice between banks and resources for Australian

investors is no longer as one sided as it had been for several years.

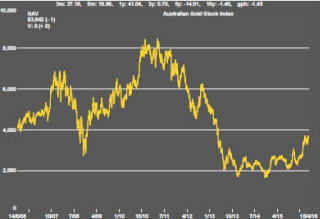

The loss of gold price momentum coincided with the climb in equity and oil prices. Since then, there has been no net gain in the gold price despite a U.S. $30/oz trading range.

Changing expectations for U.S. interest rates - with a growing bias toward fewer rate rises in 2016 - will have helped support the gold price. So, too, would the turn in the U.S. dollar have helped. With both moving in a favourable direction, the absence of a more positive gold price response suggests that it had been losing momentum after possibly having run too far.

An historically extended gold/silver price ratio reinforces this conclusion insofar as it appears that the gold price has been running ahead of the macro forces which would normally drive precious metal prices. Overall, the gold price remains confined to the downtrend around which it has been trading since the 2013.

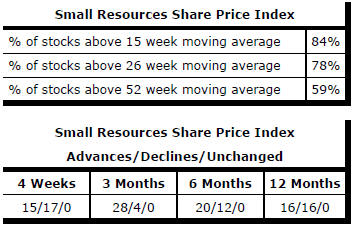

Market Breadth Statistics