The Current View

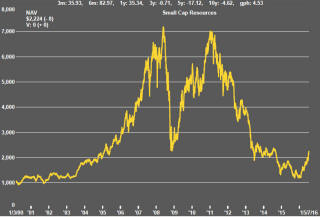

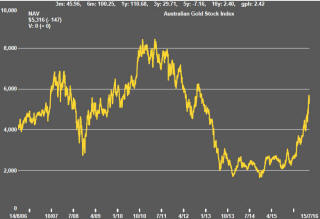

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

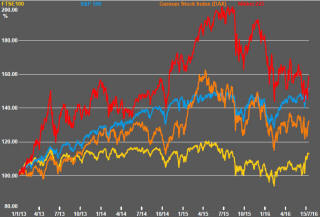

More than a decade has passed since the Dow Jones industrial average has posted new record levels on five consecutive trading days.

Sentiment has turned. Brexit panic has been cast off. Growing confidence about the commitment of central banks to provide a de facto support mechanism for markets is helping drive prices higher.

Whether equity prices can push higher from their new record levels will depend, in part, on whether new sectors are able to take the lead from those which have driven markets higher so far. A higher index is less likely without the large financial sector making a meaningful contribution.

A stronger contribution to market performance from

financial sector companies seems a challenge as long as interest rates are

not budging and operating margins remain constrained.

Exchange rate movements are another factor. All major economic regions would prefer weaker exchange rates so as to boost the competitiveness of their exports. A rising U.S. dollar - still an oasis currency - damages the earnings of those large multinational companies with the capacity to drive the major U.S. market indices.

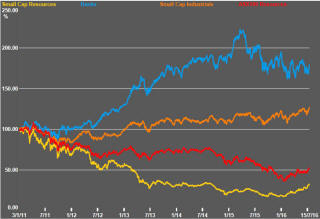

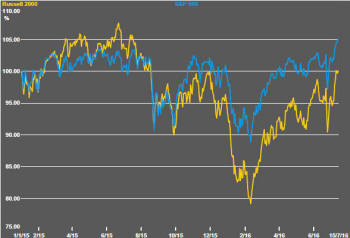

Over the week, the Russell 2000 returned 2.4% compared with a 1.5% gain in the S&P 500. The performance difference suggests that the more domestically oriented stocks are becoming more attractive, at least in a relative sense, than the larger US stocks with international exposure. That may change if the U.S. dollar again threatens to fall.

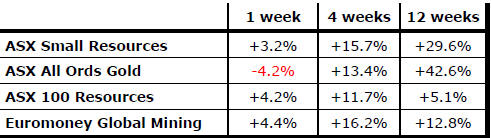

Gold price gains have been assisted by financial market uncertainties over Brexit but, before that, the likelihood of interest rates staying lower for longer than previously anticipated. A related weakening U.S. dollar has also supported the directional change in bullion prices.

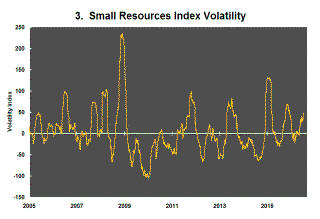

The chart shows the deviation from the 200 day

moving average for the Philadelphia Gold and Silver sector prices. At the

end of the week, that measure was sitting well above historical norms.

The market has rarely been more extended having traded at a higher premium to the average on only six days in the past 30 years suggesting that the leverage effect could become progressively less pronounced.

Gold equity prices would still rise in response to bullion price rises but the magnitude of the response will have passed its peak and come increasingly to resemble more closely historical averages. .

Market Breadth Statistics