The Current View

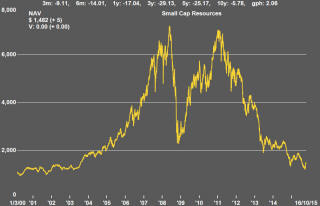

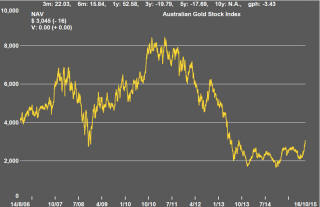

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments. The market is now entering a period prone to even greater disappointment about project delivery .

Has Anything Changed?

The assumption that June 2013 had been the cyclical trough for the market was premature.

Sector prices have adjusted to the next level of support. The parallel with the 1990s illustrated in Chart 4 is being tested. Prices will have to stabilise around current levels for several months for the thesis to hold.

Key Outcomes in the Past Week

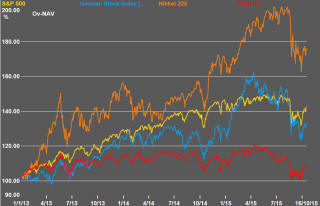

International equity markets did little more than hold the gains made in the prior week as mixed information about growth, policy and earnings removed the strong upward bias evident a week earlier.

The S&P 500 increase of 0.9% was led by the utilities and health sectors. The lead from these typically defensive sectors emphasises the connection between recent equity price performance and expectations about the future direction of interest rates. The only two S&P 500 segments that produced negative returns last week were the growth and interest rate sensitive materials and industrials.

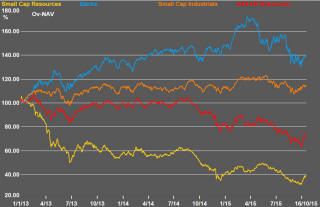

The ASX small resources share price index rose 3.4%. The S&P/ASX 100 resources index fell 3.0%. The Euromoney Global Mining Index fell 1.1%.

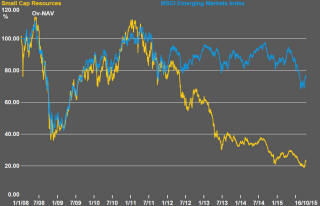

The larger end of the resources market appears to have been losing its investment comparative advantage over the smaller companies. Through the 2011-2014 downcycle, the smaller stocks fell at twice the pace of the larger stocks. There was a 39 percentage point performance gap in favour of the large end of the market. Since the beginning of 2015, the performance gap has swung around to 9 percentage points in favour of the smaller end.

The switch in relative performance is consistent with the typical progress through the cycle and is made easier to achieve by the greatly lowered base from which the smaller companies can achieve their leverage. Nonetheless, the performance switch could be taken as one sign of a market adjustment. It also signifies for everyday investors greater safety in dealing at the smaller end of the market than has been the case through the earlier parts of the cycle.

The PortfolioDirect models are reflecting the changing performance differential. During September and to date in October, the Phase I portfolio segments have added over 19% in both months. Over the past week, advances outnumbered declines among the Phase I recommended stocks by 8:2. Among the Phase III stocks, declines outnumbered advances 5:3.

It may still be too early to expect the small cap gains to be sustained or carry on for any length of time without profit taking attempts forcing a retracement of prices. With a poor history of investment outcomes extending over many years, investors will remain tempted to cash in where they perceive unusually strong gains by recent standards even at prices that remain historically low.

Despite a 23% gain in the small resources share price index since late September 2015, the absolute level of the index (as illustrated in Chart 1 on the right) remains stuck near turn of the century levels from 15 years ago. .

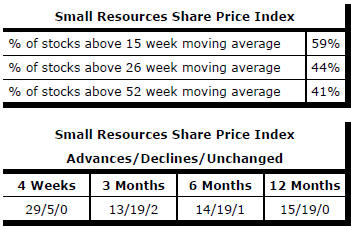

Market Breadth Statistics