The Current View

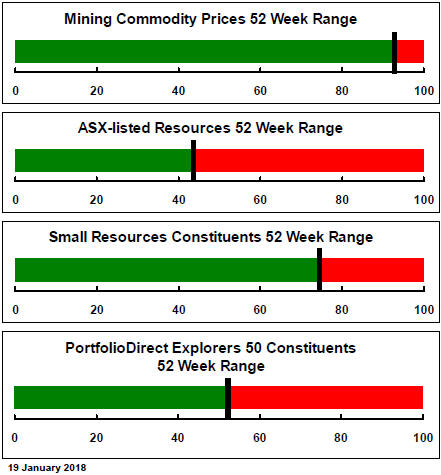

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

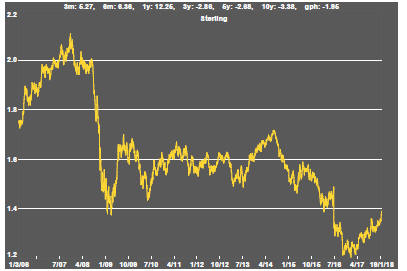

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Resource Sector Weekly Returns

Market Breadth Statistics

International equity markets - in advanced and emerging economies - continued to trade at or near record levels.

Considerations of tax policy have dominated US equity prices with earnings estimates being progressively reappraised. The US market continues to display a marked sectorial disparity in price outcomes.

Interest rate impacts are also more evident with a widening gap between financial services share price performance which are thought to benefit from higher rates and real estate and utility prices which are less favourably impacted.

The fall in US bond prices has accelerated as the prospects for growth appear to have improved in the near term. The threat of a government shutdown once again loomed large although equity investors appear to have largely shrugged off ay impact as they assume that, as i the past, the brinkmanship will conclude with some form of compromise.

The scrap over government funding might have a longer term impact insofar it is taken as conclusive evidence that proper fiscal management remains elusive despite the GOP being in control of key parts of the political process.

The US dollar has pushed toward 2014 levels offering another source of commodity price support.

In the near term, greater optimism about European economic outcomes seem to have played a role in the exchange rate shifts. Once the adjustment to better growth outcomes in Europe has been made, the balance of risk may revert to having a higher US dollar as relative growth prospects favour north America and as monetary policy tightens.

The weaker US dollar is also consistent with the broadening consensus about global growth risks. Stronger growth will attract funds to markets outside the US as the safe haven status of the US dollar becomes less needed.

One of the upshots of the currency movements has been a rise in the Australian dollar against the US dollar which has left the Australian currency pushing toward the upper end of its trading band from over the past two years.

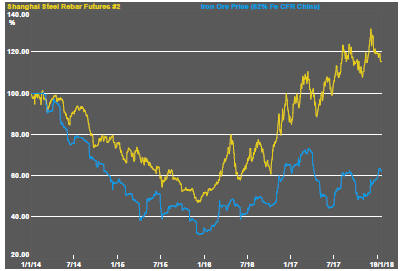

The general improvement in commodity prices since mid-2017 assisted by more optimistic assessments of global growth prospects has continued but remains consistent with the bottom of the cycle rather than signaling a more significant cyclical uplift.

Base metal prices have tended higher at the end of 2017 although the momentum at the turn of the year is not especially strong given the favourable movements in exchange rates and more optimism about global growth outcomes.

The gold sector has pushed higher although appears subdued against the backdrop of rising bond yields, falling US dollar and more buoyant growth outcomes. Gold pricing is implying some scepticism about continuation of the near term conditions supporting higher commodity prices.

The oil and gas sector remain a beneficiary of voluntary supply cuts and involuntary disruptions. Hovering in the background and potentially disrupting the market improvement is the extra supply that can come from US producers. For the time being, the balance is about right with strengthening demand underpinning the better conditions and capable of soaking up additional US supplies, to the extent they react to higher prices.

Coal and iron ore prices have ticked up signaling continued improvement in the earnings of the large diversified miners whose share prices had been flagging recently with stronger returns evident among smaller stocks in the sector.

The recent announcements about supply cuts among the largest producers did inject a slightly more optimistic tone into the uranium market but that appears to be losing momentum. Uranium related equity prices continue to travel near the bottom of their cyclical trough.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.