The Current View

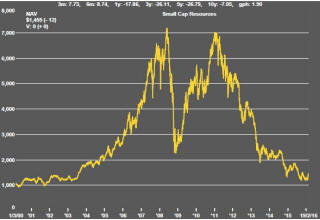

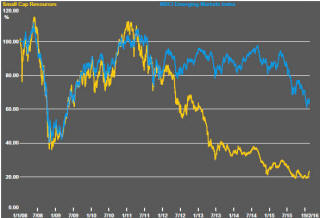

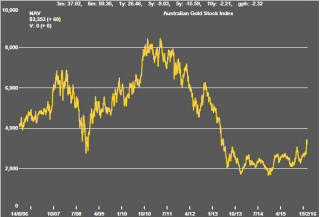

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments. The market is now entering a period prone to even greater disappointment about project delivery .

Has Anything Changed?

The assumption that June 2013 had been the cyclical trough for the market was premature.

Sector prices have adjusted to the next level of support. The parallel with the 1990s illustrated in Chart 4 is being tested. Prices will have to stabilise around current levels for several months for the thesis to hold.

Key Outcomes in the Past Week

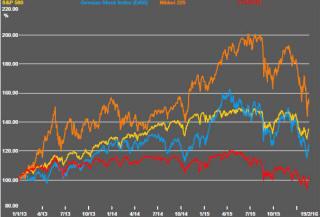

Equity markets continued the recovery which had begun at the end of the prior week although the same uncertainties about global growth and the conduct of policy persisted. A 16% rise in the price of crude oil over five days helped propel the positive sentiment.

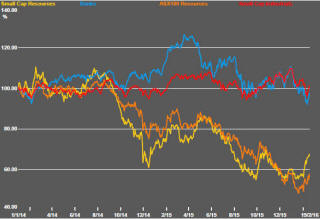

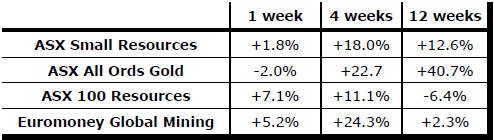

The small end of the resources sector has been showing unusual life. Over three quarters of the stocks making up the small resources share price index were trading above their 15 week moving average on Friday and the majority of stocks in the index were trading above the 52 week average. The number of advancing stocks has beaten the number of declining stocks over the past three months. Since 3 February, the index has recovered by 19.1% against a 14.8% rise in the S&P/ASX 100 resources index. Meanwhile, the banks (-0.2%) and small cap industrials (-1.1%) have both posted negative returns.

The equity price benefit of a rise in oil prices was welcomed but the leverage also suggests that any subsequent crude price weakness may push equity prices in the opposite direction.

Financial markets are habitually on the lookout for easy explanations for the most recent market moves. Sometimes, the explanations evolve into investment themes and become self reinforcing.

Low oil prices could just as easily have been taken as a sign of more robust growth and desirably low inflation. Instead, low oil prices have become a warning against slowing global demand and deflationary pressures.

Belief in the link between oil prices and growth has intensified into an important investment theme.

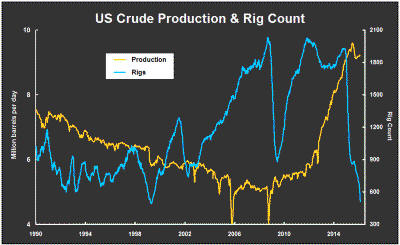

The Baker Hughes rig count for the week ended 19 February showed a drop of 27 to take the fall since the beginning of 2016 to 184. These have been the largest falls in rig numbers since April 2015.

Production has stalled as the most recent rig closures have occurred but has remained at near record levels. Less productive rigs appear to have been replaced by rigs capable of higher production rates to sustain cash flows.

In this way, many producers have been able to stave off bankruptcies and debt defaults. In doing so, they have helped avert the serious economic crisis driving the equity market fear of low oil prices.

The threat of default is resurfacing as pipeline operators are seeking to enforce contracts obliging drillers to pay them whether or not they are pumping crude. The infrastructure providers have maintained before the courts that contracts were designed to prevent bankruptcy protection being used to remove the obligation to pay.

A legal loss by the industry will result in an accelerated adjustment being forced upon it although there will be some pressure by presiding judges for the affected parties to negotiate a commercial settlement.

Deloitte has put some flesh around what the threat of widespread oil and gas industry defaults might mean in a recent report. The accounting firm foresees an increasing probability of US exploration and production company bankruptcies. It expects numbers during 2016 to surpass those in the Great Recession. Based on the number of Great Recession bankruptcies, Deloitte is estimating a 75% increase over 2014-15 in the number of companies entering bankruptcy proceedings.

Market Breadth Statistics