The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Record market prices were achieved once again although the pace of ascent has been greatly reduced.

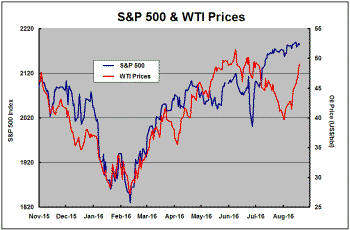

A 20% rebound in crude oil prices helped boost equity market performance but, otherwise, clear-cut directional forces have been hard to discern.

Several Federal Reserve governors opined on the

U.S. interest rate outlook without, unsurprisingly, saying anything

definitive. The release of the minutes of the last FOMC meeting also failed

to provide m eaningful

guidance on the future direction or timing of rate changes with the interest

rate setting committee divided on whether a rate cut was warranted.

eaningful

guidance on the future direction or timing of rate changes with the interest

rate setting committee divided on whether a rate cut was warranted.

UK retail sales numbers for July were well ahead of economists’ forecasts which had been hauled back in response to the vote to terminate the country’s EU membership.

More time will be needed to assess whether this foreshadows better outcomes more broadly than had been expected or whether these numbers might be an isolated result.

Perhaps the majority of the electorate which had voted to leave Europe saw the decision as less calamitous than the economists based in London who had supported retaining membership.

Japan’s TANKAN June quarter survey of business conditions produced the equal lowest reading since mid 2013 although the forecast for the quarter, produced three months earlier, had suggested a weaker quarter ahead so that the outcome was not especially surprising.

The newly published forecast for the September quarter was also positive but similarly weak suggesting little reason for optimism about a strengthening in Japanese output growth.

Several market indicators, including the direction

of U.S. bond yields, now imply that the upward trend in resource sector

prices during the first half of 2016 may have stalled after having pushed up

against mid-2015 prices.

These indicators suggest that the intense pessimism characterising late 2015 may have ended but that there is insufficient momentum for anything better than had prevailed immediately prior to the late in the year slippage.

The relatively strong market performance in the first half of 2016 can be attributed to a re-pricing of risk which is evident across a wide range of financial markets. What can move prices higher from where they are now is harder to detect, especially in the absence of stronger global growth and with credit markets already pushing against unprecedentedly high prices.

Market Breadth Statistics