The Current View

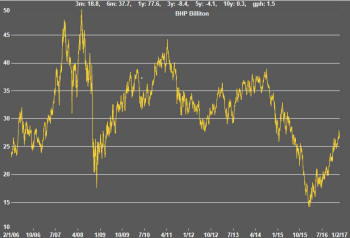

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

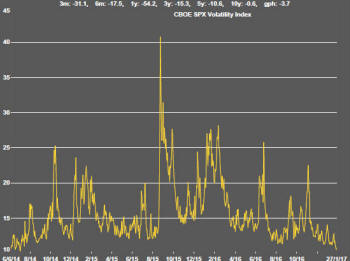

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

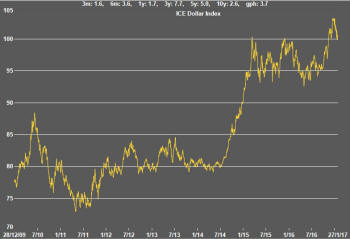

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Market Breadth Statistics

Much of the past week has been dominated by the Trump presidential inauguration with markets seemingly stalled as they wait for the new administration to flesh out its policy approaches to business.

While expected changes to corporate taxes, regulation and infrastructure spending are expected to support growth and corporate earnings, stated positions on trade policies are more ambiguous and, depending on their implementation, could stifle growth.

Trump's aggressive restatement of his views on trade in Friday's inauguration speech caused markets to modify their enthusiasm about his ascension to power.

For the resources sector and large US corporates with a high proportion of offshore eernings, a weakening U.S. dollar was beneficial although recent currency strength has been offset by expectations of an acceleration in more metal intensive output growth.

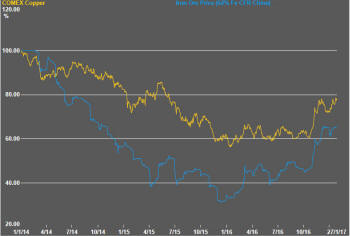

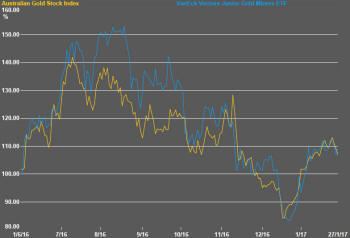

Both copper and iron ore prices have lost momentum after their earlier 'Trump-related' gains. Higher copper and iron ore prices are particularly significant as they feed into the share prices of the market leaders in the sector. The indices in which the leaders are given the highest weights declined slightly in the week.

Lower U.S. government bond prices reflecting some anxiety over the absence of policy detail from the new U.S. administration and the stridency of the new president's trade rhetoric held gold prices back.

The connection between bond and gold prices is likely to persist with the outlook for higher yields suggestive of a trend decline in gold prices.

The continuing fall in yields on higher risk corporate debt remains a positive sign for the resources sector insofar as it implies a growing appetite for higher risk equities, primarily in the oil and gas sector but, more broadly, among miners.

The uranium complex which has consistently underperformed other parts of the resources market had begun to show signs of life in recent weeks. Markedly higher volumes are an encouraging indicator of renewed interest in the sector.

Similarly large increases in volumes traded are evident in a wide range of ASX-listed uranium miners and explorers.

Despite the greater interest in this market segment, its performance still trails others in which recent rises in commodity prices has attracted investors.

The question now is whether this movement is simply bottom feeding by investors looking for underperforming parts of the market and leading to some modification of the relative

performance gap or whether it is a precursor to a longer term re-pricing of the sector to reflect the growth and pricing prospects of its constituent companies.

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.