The Current View

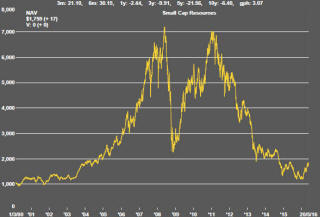

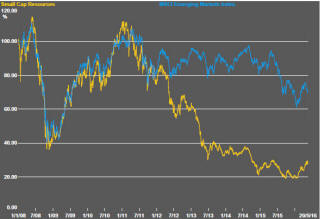

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

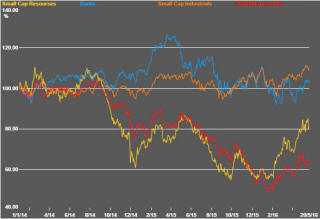

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

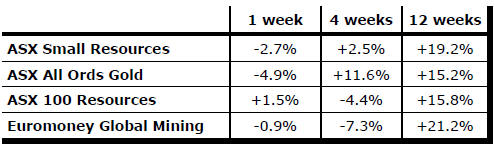

Key Outcomes in the Past Week

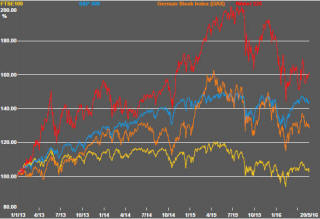

The gap between movements in the S&P 500 and oil prices widened further in the past week. The strong correlation evident over several months had little analytical support. There was correspondingly little reason, aside from market inertia, for it to continue indefinitely.

The effects on production of wildfires in Canada combined with production losses in Nigeria have legitimised rises in oil prices.

Meanwhile, the U.S. earnings picture has been patchy. Based on 96% of the March quarter company earnings reports scheduled for release, S&P 500 company earnings were 4.6% higher than in the December quarter and 6.6% higher than in the March quarter of 2015.

Sales had fallen by as much as 6.2% during 2015, a decline usually accompanied by economic recession. Their 3.0% increase over the year has provided some greater confidence to a market that had been fretting over the momentum of business sales as a clear deterioration in first quarter economic activity became evident.

In the face of easing sales and earnings momentum, the market had taken some solace from a perception that near term rises in interest rates had become less likely. Providing some further relief, a weakening U.S. dollar has helped to support the earnings of international companies in the S&P 500.

In the past week, these perceptions have swung in the opposite direction. The Federal Reserve minutes released on Wednesday intimated that a rate rise was more likely than had been widely assumed.

The accumulating economic statistics had also started to indicate an acceleration in growth going into the second quarter. With interest rate expectations changing, the U.S. dollar also began edging higher during the week.

Once again, investors are having to choose between the impacts of higher growth on interest rates and on sales and profitability.

The market seems set to enter a phase of small changes in expectations occurring frequently. Based on recent market behaviour, a period without a prolonged trend one way or another seems plausible.

These conditions will have some impact on the resources sector. Metal prices are likely to hover rather than move.

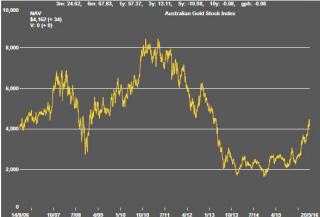

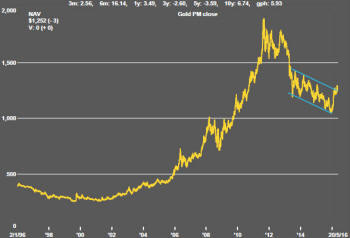

Gold Prices Struggling to Keep Rising

Recent PortfolioDirect commentaries had highlighted two competing gold price

tendencies. Since the beginning of 2016, the price had risen by 18% helped

by a falling U.S. dollar and,

related

to that, changing expectations about the tempo of U.S. interest rate rises.

At the same time, the gold price had remained within a range that had been

trending lower for three years.

related

to that, changing expectations about the tempo of U.S. interest rate rises.

At the same time, the gold price had remained within a range that had been

trending lower for three years.

Breaking through the upper end of the range seemed possible over the past three weeks but the most recent price action suggests that the market may not have had enough velocity to escape its prior history, after all. The gold price fell, albeit modestly, for three consecutive days heading toward the end of the week.

Market Breadth Statistics