The Current View

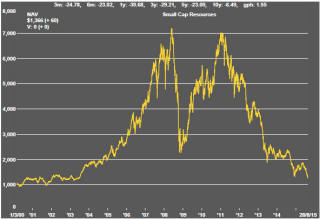

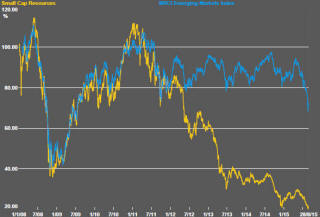

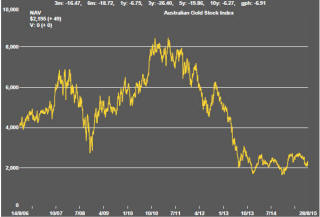

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments. The market is now entering a period prone to even greater disappointment about project delivery .

Has Anything Changed?

The assumption that June 2013 had been the cyclical trough for the market was premature.

Sector prices have adjusted to the next level of support. The parallel with the 1990s illustrated in Chart 4 is being tested. Prices will have to stabilise around current levels for several months for the thesis to hold.

Key Outcomes in the Past Week

Markets around the world retrieved a large part of their earlier losses by the end of the week leaving investors to mull over how the intersection of slow global growth, weak inflation, changing monetary policies and low energy prices will continue to affect market outcomes.

The macro landscape had not changed materially leading to this recent period of market volatility. Although a slowdown in Chinese growth has long been expected, news about its economic performance appeared to be given an increasingly heavy weighting. China’s equity markets are relatively small with limited international connections but the Chinese economy is accounting for a growing proportion of the sales of western companies.

An additional and increasingly important factor in the mix has been a growing anxiety over how well Chinese policymakers are able to manage the Chinese national economy. They had long been considered especially skilled at fine-tuning economic outcomes. The fulsomeness of the accolades they attracted was never fully deserved. Reputations were greatly enhanced by approving western business people who reported favourably on how many bridges, trains and houses were being built.

As Chinese policymakers have had to rely increasingly on more subtle market mechanisms to achieve their policy aims, the direction and impact of policy has become less certain.

The past week has offered one insight into how China could remain a source of instability for global markets for years to come. The instability is likely to have two sources. One is the remaining uncertainty as to how low Chinese growth falls before stabilising around a more sustainable rate. The second will come from attempts to anticipate policy changes and their likely effects.

The PBOC is set to join the ECB and FOMC (along with the BOJ and BOE to lesser extents) as sources of market volatility in coming years as traders to seek to guess what they will do next and when.

U.S. equity funds experienced record weekly withdrawals as sensitivity to risk rose dramatically. Emerging market equity funds also faced large withdrawals. The emerging market share price index - an important global gauge of investor risk appetite - broke the lower bound of a trading range which had been intact since mid 2009.

An important guidepost for small mining and energy companies - high yield bond prices - continued lower during the week signalling an ongoing tightening in finance availability.

The larger end of the resources market fared better in this environment. The resources stocks in the S&P/ASX 100 made a net gain of 3.7% for the week after having fallen by as much as 5.3%. The small resources share price index added 1.0% over the week after having fallen 5.5%. BHP Billiton rose 13.7% from its low in the early part of the week after making a promise to retain its dividend at the expense of its ongoing capital program. .

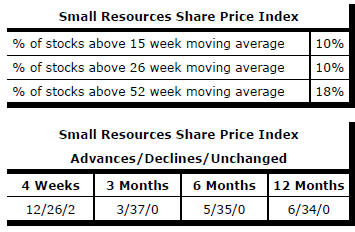

Market Breadth Statistics