The Current View

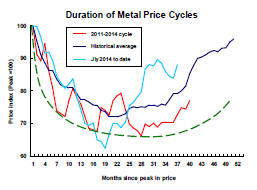

Growth in demand for raw materials peaked in late 2010. Since then, supply growth has generally outstripped demand leading to inventory rebuilding or spare production capacity. With the risk of shortages greatly reduced, prices lost their risk premia and have been tending toward marginal production costs to rebalance markets.

The missing ingredient for a move to the next phase of the cycle is an acceleration in global output growth which boosts raw material demand by enough to stabilise metal inventories or utilise excess capacity.

The PortfolioDirect cyclical

guideposts suggest that the best possible macroeconomic circumstances for

the resources sector will involve a sequence of upward revisions to

global growth forecasts, the term structure of metal prices once again

reflecting rising near term shortages, a weakening US dollar, strong money

supply growth rates and positive Chinese growth momentum. None of the five guideposts is "set to green"

(after the most recent adjustments in December 2016) suggesting the sector remains confined

to near the bottom of the cycle.

Has Anything Changed? - Updated View

From mid 2014, the metal market cyclical position was characterised as ‘Trough Entry’ with all but one of the PortfolioDirect cyclical guideposts - the international policy stance - flashing ‘red’ to indicate the absence of support.

Through February 2016, the first signs of cyclical improvement in nearly two years started to emerge. The metal price term structure reflected some moderate tightening in market conditions and the guidepost indicator was upgraded to ‘amber’ pending confirmation of further movement in this direction.

As of early December 2016, the Chinese growth momentum indicator was also upgraded to amber reflecting some slight improvement in the reading from the manufacturing sector purchasing managers index. Offsetting this benefit, to some extent, the policy stance indicator has been downgraded from green to amber. While monetary conditions remain broadly supportive, the momentum of growth in money supply is slackening while further constraints on fiscal, regulatory and trade regimes become evident.

China's Growth Steadies

China’s national statistical agency reported that the country’s GDP grew by

1.7% in the June quarter and by 6.9% over the year ended June 2017.

The June quarter growth outcome shown in the chart was

consistent with the pace of growth during the past two years but a

surprisingly strong result against the backdrop of a policy commitment to

source more growth from consumption and reduce dependence on investment.

Growth in the June quarter recovered strongly from the relatively weak March quarter result which had been similar to the corresponding quarter in 2016 after which the government took steps to push growth higher.

At one level, the growth outcome is a welcome relief for the mining industry which depends on China for a disproportionately large share of raw material use.

At another level, the news is less fortunate insofar as the slowdown which had been widely expected is still ahead.

Some slowing within a restructured and more efficiently performing economy is inevitable but being delayed by the government’s tolerance of high rates of lending growth to sustain investment spending.

The

second chart illustrates the extent to which growth in Chinese loans

outstanding has remained remarkably strong and, at around 12% a year, well

ahead of the value of output growth.

The

second chart illustrates the extent to which growth in Chinese loans

outstanding has remained remarkably strong and, at around 12% a year, well

ahead of the value of output growth.

Chinese monetary authorities have spoken frequently and over many years about the need to curtail lending growth without having had the courage to enforce their views.

Few analysts believe that the current pace of lending is sustainable. The longer it persists, the more likely is a sudden slowing at some later point as the government has to more aggressively rein in monetary conditions.

The other problem raised by the current lending practices is the falling real output payback.

The declining productivity of the lending institutions

is an incentive for China’s One Belt One Road initiative which, if

successful, could help stabilise the financial system to the extent national

savings can be deployed in opportunities with higher real rates of return

than those available within a more slowing growing domestic economy.

Trade data released by the Chinese government customs agency has also indicated some improvement in domestic and international economic conditions.

The trend turn in exports suggests an improvement in global trading conditions which economists had viewed as being a constraint on growth and a source of downside risk for the world economy.

Improved export performance is also consistent with the country’s need to purchase a larger quantities of raw materials to bolster its manufacturing capacity.

Trends are moving in the right direction for the mining industry but the momentum remains modest by historical standards and insufficient to warrant a significant reappraisal of global growth in the immediate future.

Copper Use Falls

The International Copper Study Group reported that copper use in the first

four months of 2017 was 2.7% lower than in the corresponding period of 2016.

If sustained over the balance of 2017, the magnitude of

the contraction would be similar to the pace of growth in the early 1990s

and the third consecutive year of below average growth in metal use.

While many in the industry have expressed concern that lack of investment is constraining mine output, the weakness in metal use appears to be offsetting the need for higher rates of output.

Market balances have only changed very slightly during the course of 2017 but, so far, appear to be weakening.

Despite the deteriorating market balances, copper prices have strengthened in recent weeks.

Higher copper prices need to be viewed in conjunction with the significant fall in the U.S. dollar.

The currency movement would have normally implied a far greater positive price effect than has actually occurred. Weakening physical market balances would have contributed to the disparity.