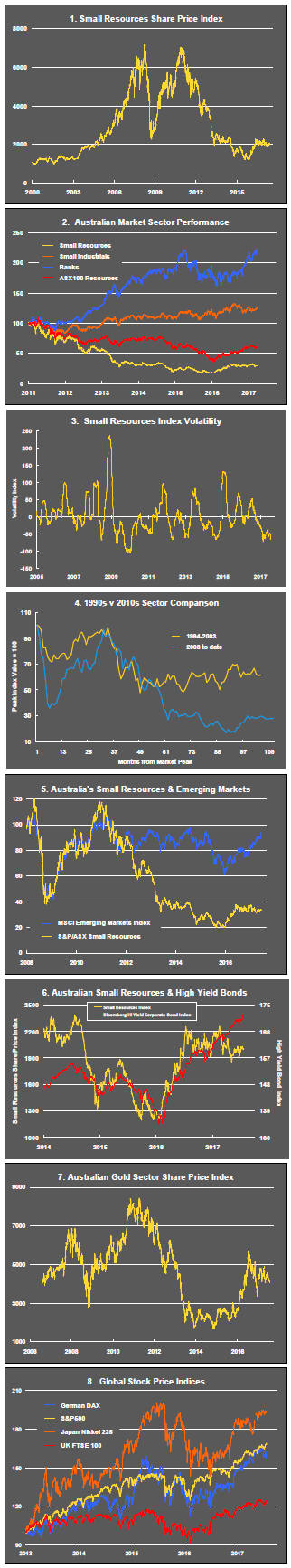

The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

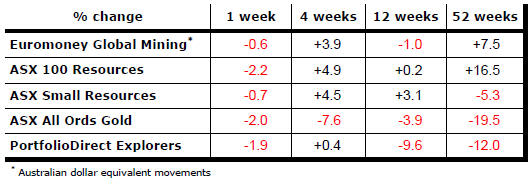

Key Outcomes in the Past Week

Market Breadth Statistics

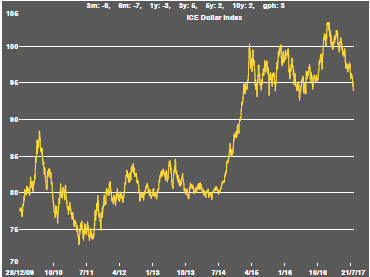

The U.S. dollar decline continued in the past week with the currency reaching the lower end of the range in which it has traded over the past two years.

The directional shift dating from early 2017 reflects a changed view about relative interest rate and growth outcomes.

An earlier expectation of accelerating U.S. economic growth and rising interest rates outpacing changes elsewhere has given way to more bullish expectations about European growth and how quickly monetary authorities there will begin to normalise policy.

Among the beneficiaries of a weaker dollar should be commodity producers and U.S. reporting companies with significant offshore operations.

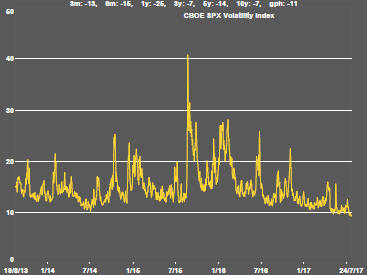

Volatility measures suggest confidence about the equity market outlook despite the recent strength.

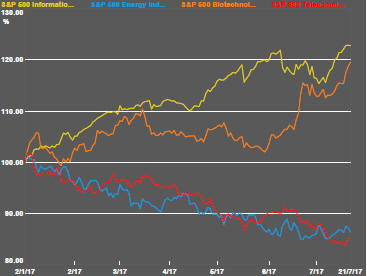

The U.S. market has displayed a clear cleavage during 2017 between the information technology and biotechnology sectors, on the one hand, with gains of around 20% and telecommunications and energy companies, on the other, with losses of around 15%.

Industry restructuring and sectoral market conditions are proving more powerful than macro influences in many circumstances in determining overall market outcomes.

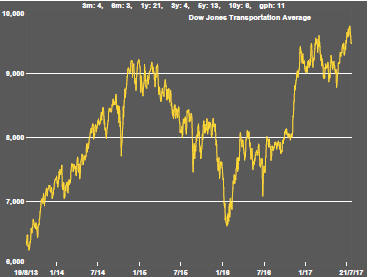

The Dow Jones transportation index, often used as an indicator of U.S. domestic activity and a leading indicator of future broader market moves, fell during the past week.

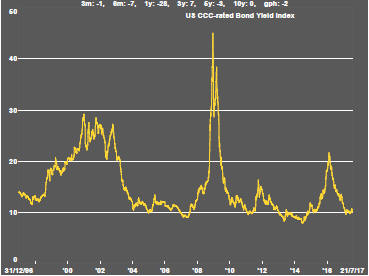

Yields on the lowest rated corporate debt edged up slightly but remained near the bottom of their historical range suggesting a broad appetite for risk assets has been retained.

The weaker U.S. dollar has not been an obvious benefit for non-ferrous metal prices as might have been expected. Over the year so far, lead and aluminium prices have outpaced the rest of the group with gains of 10-12%. Nickel and tin prices are down 5-6% after having lost as much as 10%.

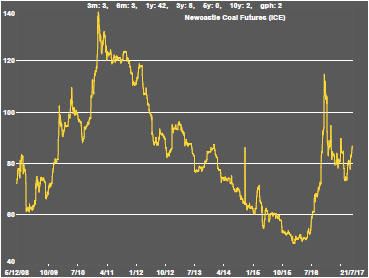

Coal prices have retreated from their most recent upward spurt but strengthened during the week as uncertainty persisted about the future of Chinese demand and the extent to which those needs will be sourced domestically.

The gold price continues under the influence of movements in exchange rates and bond prices. In the past week, both - that is, a lower U.S. dollar and lower bond yields/higher bond prices - have moved in favour of gold prices.

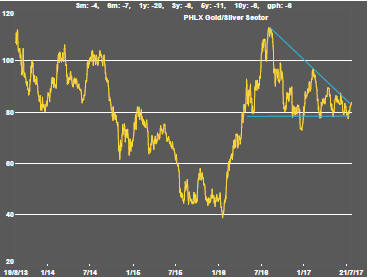

Gold-related equity prices have been responding less strongly to rises in bullion prices suggesting a lack of conviction about their price prospects.

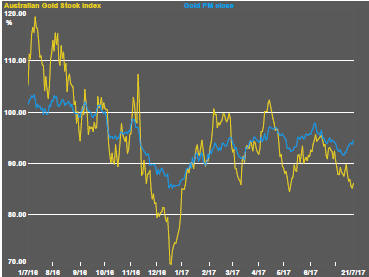

Another indicator of the doubts about gold-related equities is the growing divergence between the Australian gold stock index and the gold price.

The performance difference between Australian equity prices and the bullion alternative reflects the broader lack of responsiveness in the equity market to gold price movements as well as the recent strength in the Australian dollar.

There has been some tendency for these performers disparities to be reversed quickly. Any move down in the Australian dollar, as long as the gold price has not changed significantly, should prompt outsized gains for Australian gold stock prices.

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.