The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

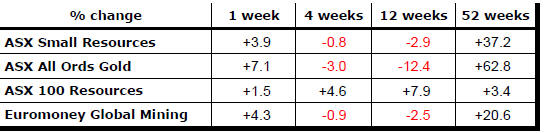

Key Outcomes in the Past Week

Exchange rates resurfaced as important market influences in the past week.

The US dollar appreciated a further 0.6% against the basket of major trading partner currencies as it again moved into the upper half of the trading range it has occupied for nearly two years.

The principal influence on the currency appeared to

be the strong likelihood of an interest rate rise in the USA in December

while monetary authorities in Japan and Europe continue to talk about taking

further easing measures.

The 2.4% decline in the Japanese yen since the end of September, the flip side of US dollar gains, has contributed to a 4.5% rise in the Nikkei 225.

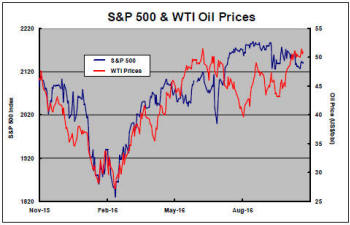

Relatively high oil prices were sustained for another week helped by expectations of a production agreement among the major non-U.S. producing countries.

Improved oil prices helped sustain the broader U.S. equity market which had been under pressure from a mixed earnings picture and growing expectations of higher interest rates.

After having fallen $90/oz since late September,

gold prices struggled to recover but did manage to add $15/oz. Other metal

prices, including precious metals, lost ground.

US bond yields remained at elevated levels similar to those which had prevailed in the first half of 2016.

With gold sector equity prices having already fallen by nearly 30% since early August, relatively strong gains were experienced in response to the firmer bullion prices. The All Ordinaries gold price index rose 7.1%.

Uranium sector prices remained stuck within a weakening trend which has been evident for well over four years. Uranium remains the one segment within the resources sector to show negligible correlation with the rest of the industry despite the evidence of a likely future increase in demand.

Troubles in Europe

Moves by the UK to leave the European Union have remained a background

factor as the UK government grapples with how to define its exit.

The ongoing role of London based financial institutions is one source of anxiety. The extent to which other British firms will be able to access the common market is a more general business concern. These are matters on which there is no agreement within the UK and which are likely to take several years to resolve fully.

The government in Dublin has also flagged difficulties facing the Irish economy because of its heavy reliance on exports to Britain.

The British government has raised the possibility of a dramatic cut in corporate tax rates to retain business investment in the event negotiations with Europe prove difficult. This would be another severe blow to the competitive position currently enjoyed by the Irish Republic.

Meanwhile, a Belgian regional parliament has threatened to veto a European trade deal with Canada highlighting the extraordinary complexity for any country trying to negotiate market entry terms.

The scene is being set for an unprecedented negotiation over the structure of European economic relationships. A scenario is emerging in which an agreement is never completed.

Despite the stronger US dollar and its

adverse impact on raw material prices, equity prices gained ground with

especially strong gains among selected Phase I stocks and companies with gold

exposure.

‘Steak or sizzle?’ is a commentary on the top five performing ASX resources sector stocks in the past week. LINK

Market Breadth Statistics