The Current View

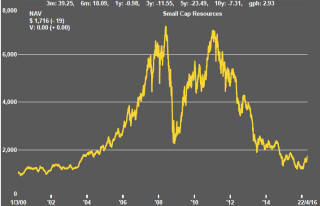

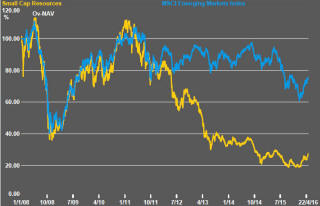

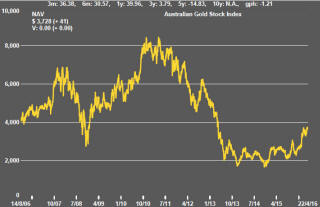

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

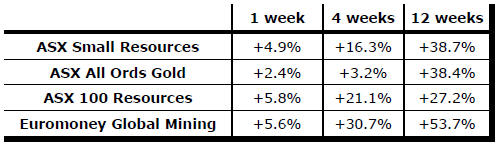

Key Outcomes in the Past Week

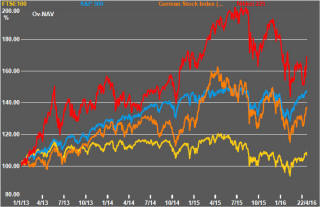

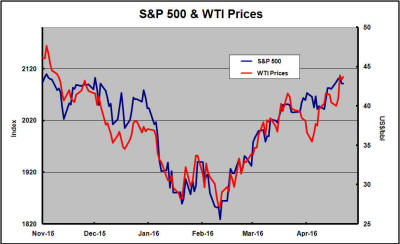

Once again, the oil price connection to equity markets was a feature of the week’s trading. The day to day connection has been somewhat loosened in the past two weeks but the directional relationship appears intact.

The upward movement in the two prices is now probably more coincidental and less causative.

Oil prices are being helped by some evidence of market adjustment. The International Energy Agency has intimated that the world market may be within 12 months of turning from surplus to balance. Iranian officials have foreshadowed being able to restore the country’s pre-sanctions oil production by the end of June. Saudi Arabia has continued to hint at the possibility of a production freeze later in the year. With Iran no longer trying to gain market share, this prospect becomes more realistic.

Equity prices, meanwhile, have relied largely on P/E ratio expansion supported by the prospect of relatively low interest rates extending indefinitely, rather than earnings growth. More positive commentaries about US earnings in future quarters coming from some companies reporting earnings in the past two weeks have helped stoke interest. Improved interest in commodity and manufacturing related equities has supporting markets by enough to offset weakness elsewhere.

Significantly, at the end of the week, the technology sector lost ground against the rest of the market. This is where valuations were most stretched and where any reorientation of portfolios toward old-style companies will also be evident.

The debate over whether Britain should remain a member of the European union was enlivened by an intervention from U.S. president Barack Obama in favour of the UK retaining its membership. The president’s entry into a domestic political debate was unusual but he appeared to have helped prime minister David Cameron rally support at a critical time and, importantly, reduce the uncertainty that appeared to be gathering over markets.

By the end of the week, markets had started looking toward the Bank of Japan for directional guidance. Rumors circulated of more dramatic action by the BOJ, including a significant ramping up of equity purchases, after its meeting this week.

The U.S. Federal Reserve is also scheduled to meet this week. It now appears to be on an interest rate holding path. Neither inflation nor GDP growth appears strong enough to warrant a further rate rise for the time being. The argument for holding fire is reinforced by recession-like conditions being experienced by U.S. companies whose sales are 2-3% lower than a year ago.

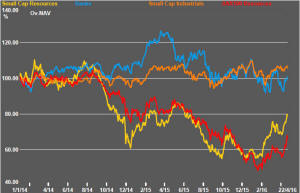

Higher commodity prices partly helped by some stronger evidence of a weakening U.S. dollar have added to interest in resource sector equities. Gains have appeared across all categories of companies although the Phase II group of companies appear to have lagged the pack somewhat.

Phase III companies benefit most immediately from fund flows through institutional investors with a focus on larger companies. Phase I companies have gained performance momentum from their leverage to even the most minor changes in conditions at the bottom of the cycle after share prices have fallen by 80%+.

Phase II companies, the ones most in need of funding completions, have received the least near term support suggesting that their predicament remains difficult to surmount. Their absence from the price rally might also suggest a lack of confidence about the sustainability of the current revival in prices.

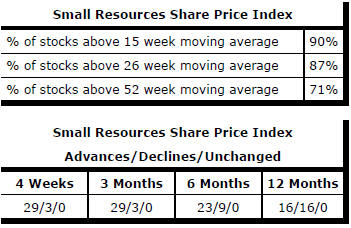

The overwhelming majority of stocks within the small resources share price index have had positive returns over the past four weeks and are running above their moving averages. Since the beginning of January, the prices of 239 stocks in the sector have risen by more than 20%. Another 93 have had lesser positive returns. The prices of a further 265 stocks have declined by an average of 25%.

Market Breadth Statistics