The Current View

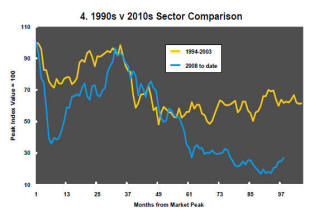

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Brexit wrong-footed markets globally after confidence had grown during Thursday that the ‘Remain’ vote would carry the day. As the reverse was becoming clearer, markets began to fall dramatically.

The brunt of the equity market impact was felt by European based financial institutions. The share prices of companies with the least exposure to the UK and Europe appeared the most resilient.

Outside Europe, the Japanese market was hit hard by the double exposure of its exporters to the European market as well as the impact on earnings of a rising yen being used as a safety play against the risk of financial market disruption.

A scheduled Russell equity index rebalancing on Friday boosted market volumes but occurred largely without incident suggesting that markets were working in an orderly manner to process orders. There were no reports of liquidity shortfalls or central bank interventions.

The Euromoney Global Mining index fell 3.0% on Friday after the Brexit vote but remained 1.1% higher than its closing a week earlier.

The price range over the week suggested that resource sector prices were also wrong-footed by the vote but that traders did not consider the impact particularly severe.

The market reaction was reminiscent of the late 1990s when the Asian financial crisis and Russian debt default caused widespread consternation within financial markets but had limited effects on resource sector equity prices which were already trading around cyclically low levels.

Market nervousness cause a flight to safer

assets including gold although the resulting 4.7% movement in bullion prices

on Friday was modest. Despite some expectation of a leveraged response by

gold mining equity prices to the higher bullion prices, the equity reaction

was muted. The Philadelphia gold/silver sector price index rose 3.6%. The

NYSE index of unhedged gold stocks added 6.0%. The Market Vectors Junior

Gold Miners exchange traded fund (GDXJ) rose 4.8%.

The relatively subdued equity market response would have reflected the more general weakness in equity market conditions.

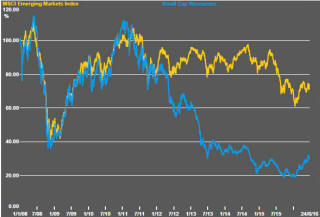

The extent of the leverage may have also been decreasing, in any event given prior price adjustments. Since the beginning of 2016 (the period depicted in the chart), the gold price has risen 24%, predominantly in the first quarter of the year. Over the same period, the gold miners ETF rose 117%, most of which came after the end of the first quarter.

One inference from the relative moves is that stock buyers have needed convincing about the sustainability of a gold bullion price increase before deciding to embed the change in equity prices.

It would follow that gold equity prices retain some further upside potential in the event that the end of the week rise in gold prices can be sustained beyond the immediate reaction to the Brexit vote.

Market Breadth Statistics