The Current View

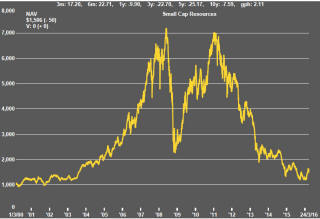

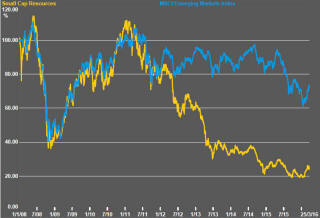

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

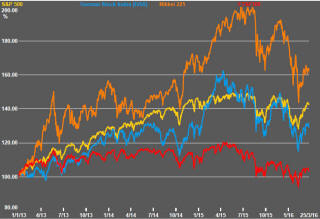

Yet another week has passed with US equity markets following in the footsteps of oil prices. This time, neither was able to sustain their peak values.

There is no sound analytical reason why both prices should continue to move in lockstep. Eventually, one or both markets will reach a point that reflects (or exceeds) what the next investor is prepared to pay precipitating a retracement in one or both markets. That point might have been reached, at least temporarily, after rapid rises in the two markets since 11 February.

One unusual influence in the past week came from the US dollar which rose 1.2% against a basket of currencies resulting in renewed downward pressure on both commodity prices and US corporate earnings with adverse consequences for equity prices. The currency moves did, however, favour emerging market securities.

The plethora of Federal Reserve governors speaking their mind publicly, reflecting the structure of policymaking in the USA, runs the risk of confusing investors with their sometimes inconsistent statements about the likely evolution of monetary policy.

The balance of the most recent statements has implied that policymakers would continue to push for higher interest rates. This came after markets had recently begun to infer less pressure in this direction. At the same time, Fed speakers are also adhering to the line that policy will be data dependent. This leaves open the confusing possibility of short-term conditions, driven by the flow of data, precluding the Fed from taking the necessary short term steps toward its long-term goal of normalising interest rates.

This stance also leaves judgments about the direction of policy at the mercy of individuals’ views about the flow of data. So far, non-period Fed views have proven more realistic than those of the governors

Continuing week to week changes in inferences about the policy direction or pace of change remains a likely feature of market conditions.

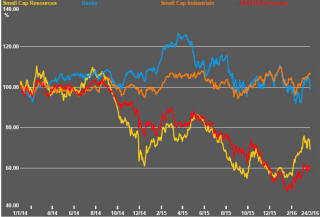

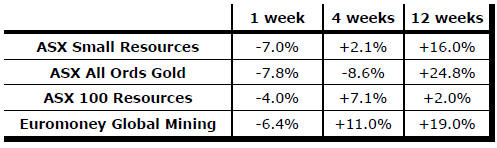

A step-up in sector price volatility - illustrated by

Chart 3 in the right hand panel - raises the likelihood of an upcoming

period of resources company share price weakness after volatility had

tracked toward the lower end of its historical range, a move which would

typically support higher prices.

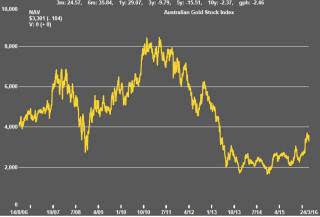

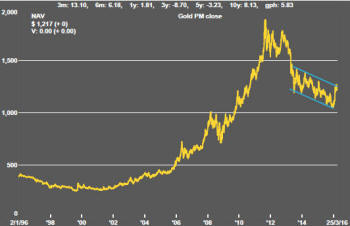

Gold prices, which fell 3% over the week, are reflecting the varying perspectives on monetary policy. Expectations of higher US interest rates accentuate downward pressure on gold prices. A refocus on less aggressive policy outcomes encourages higher prices. Price fluctuations are occurring in response to these changes in perceptions about policy without any emphatic change in direction.

There is downside risk to the gold price as long as it

is trading at the upper end of the declining trading range which dates from

2013.

Another sign of downside risk is the extent to which the gold price has run ahead of silver prices. The gold-silver spread is now at the top end of the historical range. This would normally raise the likelihood of a potentially rapid rise in the price of silver to bring it into line with the prevailing macro conditions or a gold price decline for the same reason. The macro indicators are suggesting a bias toward the latter.

There is a risk while this scenario plays out for Australian gold producers to face a rising Australian dollar while US dollar gold prices begin a decline.

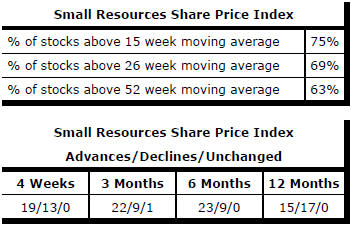

Market Breadth Statistics