The Current View

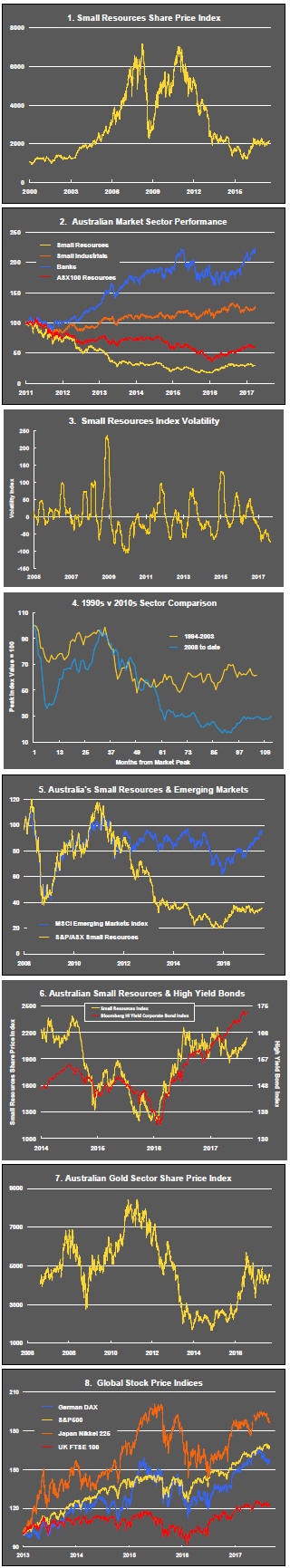

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

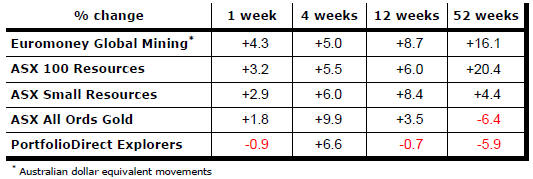

Key Outcomes in the Past Week

Market Breadth Statistics

Market volatility itself has been volatile as political controversy in the USA and worries about the government of north Korea precipitating a nuclear warhead exchange have disrupted markets.

Given the apparent seriousness of the geopolitical backdrop to markets, the response could be construed as only modest.

The overall S&P 500 outcome remains the product of disparate performances among sectors.

The renewed S&P 500 volatility and the weakening index have coincided with strong recent gains in emerging market equity prices.

Emerging markets are responding to perceptions of lowered risks to global growth and the flow of funds in response to cross-country differences in market valuations.

The U.S. dollar has held up for the time being around the low end of the trading range which has persisted over the past two years.

Analysts listened closely for hints from the meeting of central bankers in Jackson Hole last week about likely directions for monetary policy and differences in the timing of policy changes which might affect currency markets but nothing material seemed to emerge.

The currency has already adjusted to significant changes in views about relative growth rates and interest rate changes. The potential direction of the next change in expectations is less clear.

The possibility of U.S. growth outcomes combining with tightening policy to push the currency higher remains. The alternative is also a realistic possibility but the balance of risks appears to favour the U.S. economy outgrowing Europe rather than the other way around.

Currency adjustments have helped drive non-ferrous metal prices higher with the prices of all the main products, with the exception of tin, converging on near record levels for 2017.

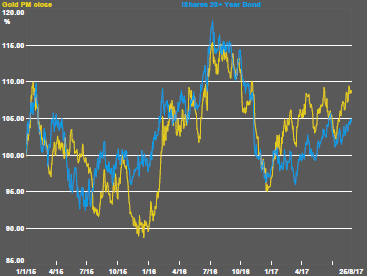

The direction of gold bullion prices has remained under the influence of financial markets and, in particular, movements in U.S. bond prices. Combined with a beneficial currency effect, gold prices are now near the highest levels reached in 2017.

And

The response of gold-related equities to gold bullion price rises has been more subdued than usual as though the equity market is discounting of the likelihood that bond yields and the U.S. dollar will continue to fall. In other words, equity investors are more bullish about growth prospects.

Oil-related equities, like their gold market counterparts, have also responded less strongly to commodity market conditions.

The uranium sector remains conspicuously stuck within its cyclical trough.

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.