The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Markets are losing momentum. Where gains are still being made, they are no longer coming as easily.

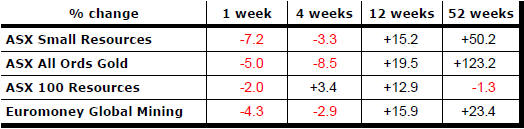

Both large and small resources stocks lost ground over the last week. The largest sector stocks listed on the Australian market have now given up all the gains made over the past 12 months. The S&P/ASX 100 resources share price index finished the week 1.3% lower than 52 weeks earlier.

The sector needs a new force to move prices higher after having made strong gains from an unusually weak cyclical position during the first half of 2016.

The U.S. dollar remained in the narrow range it has occupied since early 2015 but a slight upward bias in the past week detracted from U.S. dollar denominated commodity prices, including gold and oil prices.

By

the end of the week, gold equity indices were lower by as much as 11% on

U.S. markets after gold bullion prices declined 2.0%, foreshadowing some

further losses in Australia when markets reopen after the weekend.

By

the end of the week, gold equity indices were lower by as much as 11% on

U.S. markets after gold bullion prices declined 2.0%, foreshadowing some

further losses in Australia when markets reopen after the weekend.

The influence of the Federal Reserve was again prevalent with the annual gathering of central bankers in Jackson Hole raising expectations that Federal Reserve chair Janet Yellen would offer an insight into when the next rise in official interest rates is likely to occur.

Unsurprisingly, after she spoke, some thought she had said something significant; others felt they were none the wiser.

The Fed’s deputy chair subsequently offered some clarifying remarks which intimated that the labour market had reached peak strength opening the way for at least one rate rise before the end of 2016.

Even those comments were open to interpretation about the market impact this course would have.

A rate rise could engender greater optimism about growth which would benefit commodity markets and growth oriented investments. On the other hand, expectations of higher rates place an upward bias on the exchange rate which detracts from commodity related investments and the earnings of those companies with international sales.

For the time being and in the absence of countries outside the USA showing comparably strong growth, higher U.S. interest rates seem more likely to push the dollar higher without impacting positively on the international growth outlook.

Market Breadth Statistics